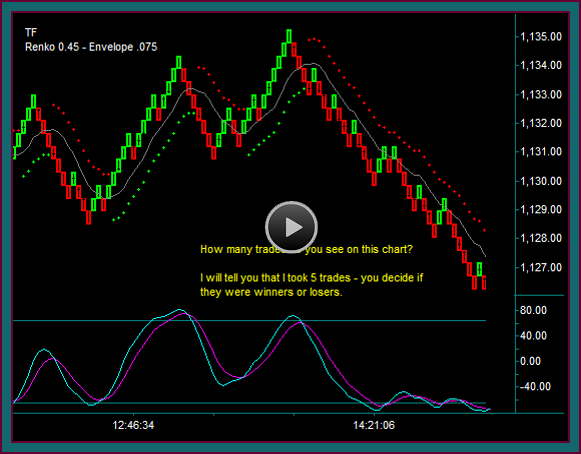

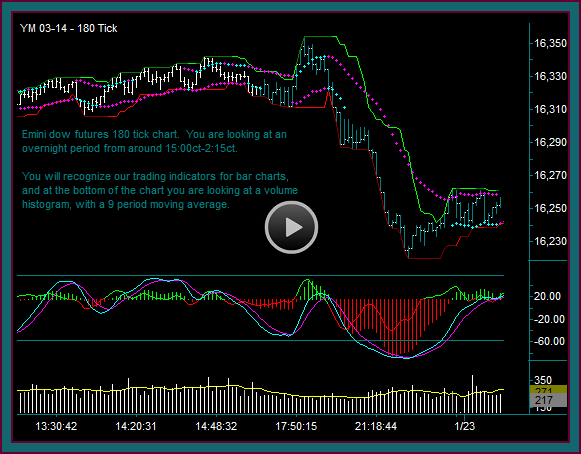

In this renko chart trading video, I am going to start at the price envelope reverse of an emini dow futures buy swing, and discuss screen prints that I made with each day trade and trading management decision at profit targets.

I would actually like to do a emini dow day trading chart recording and discuss charts and trades as they happen – but it hasn’t really seemed to be feasible in terms of the large amounts of time where nothing would be happening and there would be silence.

For instance, the renko chart day trades and setups that we are going to discuss on this video span over an hour. So, I am going to discuss all the individual chart screen prints, from when I made the related emini dow day trading decisions.

Emini Dow Day Trading 2-3-2014

You are looking at my emini dow brick1 renko trading chart – renko brick 4 and price envelope percent .045.

I intentionally did the trades before the market day time session. This would especially be for traders outside of the United States, as well as for traders that may only be able to trade earlier in the morning because they have a job.

I am going to primarily discuss the renko chart trades that were done after the price envelope reverse, but I want to discuss the emini dow day trades in the buy swing first.

Yellow Dot1-Yellow Circle 1

- Buy the yellow dot 15613, with 15630 price target1 [15627 renko]

- Renko chart triple top breakout potential – synchs with the 180t and a shift line-pmd low counter point triple top breakout potential

- The yellow circle is a continuation addon setup that would have 11 points of profit room

- I didn’t do this trade as an addon, but with the breakout potential – I would have done this trade if there wasn’t a setup at the yellow dot

- Hold the price envelope reverse – it is directly into price support

Yellow Dot2

- Support held and the renko chart went back into buy – the 180t was always in buy

- Buy yellow dot2 15648 as a resumption addon, which synchs with the 180t and a pmd failure

- If you look at your 180 tick chart you might feel that 15655 is resistance, but note that this would be a triple top break when hit – price resistance is 15682

- Price went to 15678 with a momentum extreme

- Take 2 addon partials and the 2nd initial trade partial

- The timing was the red brick and done at 15669 – then go flat the addon on the price envelope reverse at 15661

Renko Trading Chart Price Envelope Reverse

Just as an fyi, if I had recorded the charts from yellow dot1 to the price envelope reverse, 2 hours would have gone by.

What I want you to see on this screen print is what you should be specifically watching for as a renko trade setup alert:

- Price envelope reverse with a mex extreme cross

- 2 bricks that include the reject brick, which would be a midline reject with mex flow

- BUT you don’t have a complete setup or trade yet

Yellow Dot1

- Now you have a completed renko sell setup – sell 15656 as a reverse out of the trailing 15613 renko buy

- The price target is 15624 – renko 15627

Yellow Dot2

- Renko base continuation setup done as an addon – sell 15640

- It’s a smaller profit target than I would like at 16 points – but I would also be fine with getting to the blue line and having those points

- NOTE: partial1 has not been taken yet on the initial sell

15627 Renko Price Target

- We are at 15627 and have just started another red brick – you can also see that mex is at the extreme line and ‘flattening’, but there is no cross

- I would like to get the brick to complete and continue the move and extend my partials

- I am ready to partial on the initial trade [my finger is on the button so to speak] if mex crosses or I see a green brick – and my major concern right now with the addon is to be sure that it isn’t a losing trade if this is the swing low

- The next target is 15613 price – 15611 renko

15611 Renko Target

- Price did go through and hit the 15611 renko target – 15609 price low

- Based on 3 contract trading size units – there are 2 partials filled at 15613 and 2 filled at 15611

- Trailing 1 initial sell and 1 addon sell and a green brick, with the mex extreme cross – I am watching the green brick that just started and getting ready to exit the addon

- Good profit expansion on the initial trade, from the 15627 renko management decisions – this was responsible for 15655 to 15613 = 42 point partial 1

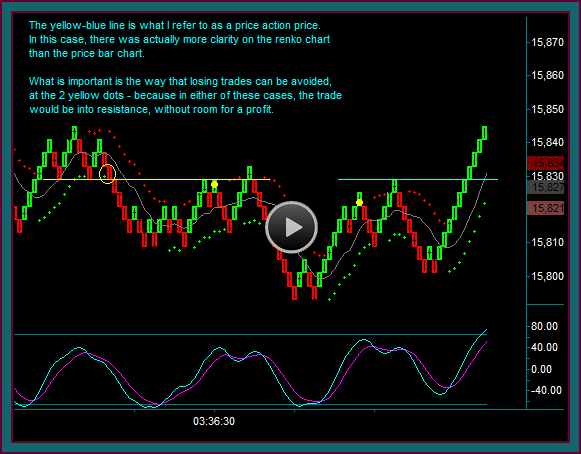

Renko Chart Price Envelope Reverse

- 15611 renko double bottom with the mex extreme cross

- Price envelope reverse – 15621 addon exit and 15629 initial sell exit

- With this price envelope reverse is there a renko trade setup alert like the reverse from buy to sell – definitely not

Renko Chart Sell Resumption

- There is never any renko trading chart buy setup to consider after the yellow circle – and then there is another price envelope reverse, taking the swing back into sell

- I missed getting the screen print done on the green bar – but you would have the same renko sell setup alert like the first sell

- You would see the price envelope reverse, followed by the 2 bricks – with the green brick-midline reject brick with mex flow

- Sell the yellow dot 15620

- The target at the 15609 price is only 11 points – but there is also the triple bottom breakout potential of the blue line-2 blue squares

- And I tried the trade with the next price target if through at 15591

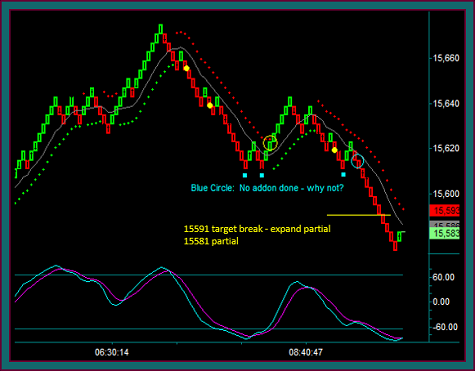

15591 Price Profit Target

- To begin with, I didn’t do an addon at the blue circle – why not?

- Is it because of a good reason – there really was no reason not to

- There is a 4 brick reject instead of 3 and mex pinched – but the 180 tick shows a triple bottom breakout with mex flow setup

- Filling 15613 would have 15591 as the price target = 21 points

- Is it because of a good reason – there really was no reason not to

- Again it was like that first buy addon that wasn’t done – I didn’t want an initial trade and an addon trade needing breakout potential to get a profit on either of them

- This was another example of expanding partial1 by chart reading at the target

- The mex flow pinch opened back up and I could again monitor for brick continuation

- And there was a 15581 partial when mex flow started the cross and I got the green brick

That ends this video discussion doing a ‘step-by-step’ walk through of the renko trading chart emini dow day trades, along with the renko chart trade management decisions. At the end of this chart I am still short 15620, with the 15581 partial, and trailing – again as discussed, there was not addon trade done on this swing.

Be the first to comment