In this video, I want to discuss emini dow day trading and reasons for adding it as another index future, to our trading list that includes the emini russell, euro currency, and crude oil.

Back in 2004, the emini dow futures was actually the only index that I was day trading. But then in September of that year, I started with the emini russell and haven’t day traded another index future since then – until today that is, when I did some emini dow futures day trades.

Why Trade The Emini Dow Futures?

As I mentioned in my email update, this was the result of another trader’s questions. And I also wanted to discuss this, because of another trader’s questions about sp500 emini day trading, which I really couldn’t give good answers to.

So, why trade the emini dow – and no, I am not replacing the emini russell, which is still my index of choice to day trade – here are some things to consider:

- I like the alternative of having multiple futures contracts to trade, especially with the additional selectivity of the renko base trade setups.

- I might not have an index trade setup, but there might be one on oil or the euro currency, or a forex pair if that’s what you are trading.

- You can get the emini dow, euro, and oil data through a cme exchange subscription – the emini russell data would have to be added to that

- If you are a trader using NinjaTrader and Kinetick data, you can get the emini dow but not the emini russell

- If you are a beginning trader to real money trading, you might not want to trade the emini russell to start, with its bigger point value and starting initial risk

- The emini dow will have smaller partial targets and smaller initial risk – again this would be good for beginning real money trading

- The trade-off will be less profit potential, because of a smaller average swing size and smaller price per tick-point

- The emini dow appears to have enough volume and activity to trade overnight and before the market day session

- I like this, because of the time I get up in the morning, and it would be particularly beneficial to traders outside of the US

- The trader who asked me the questions is in the Netherlands – and we have traders in the group from a number of other countries

So, all of this sounds good and the dow jones emini is an index future I could potentially recommend day trading.

Why do I say potentially?

Because, I don’t want to make too much of only trading this for 1 day – it should be profitable with a directional move of down over 150 points at the time I sent my email. But I did get to look at some past charts that have some good renko base trade setups.

Emini Dow Futures Overnight Volume

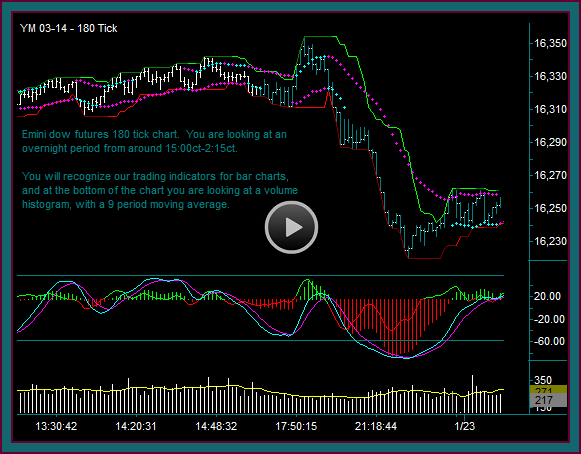

You are looking at the YM 180 tick chart – that will be the bar chart we will use. I will be showing you YM renko charts in a moment – those will be 4 renko bricks, and the price envelope percent setting is .045.

The first thing I did when I looked at the charts was to add a volume indicator with a 9 period moving average. You can see on the chart where I marked a couple of times and the volume:

- 18:00ct the volume was 240

- 21:15ct the volume was 265

These numbers compare to a 9 period moving average of volume at 9:00ct of 286 – which is how I have concluded at this point that the emini dow can be day traded overnight.

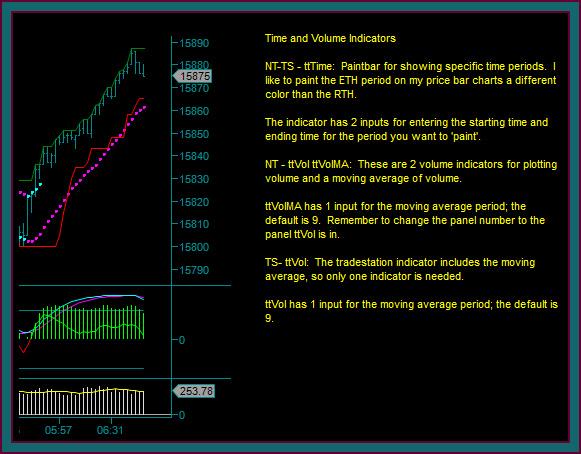

NinjaTrader And TradeStation Time-Volume Indicators

Download the time and volume indicator files for NinjaTrader and TradeStation – look at the chart below for notes about the indicators and the inputs.

NOTE: Import the NinjaTrader indicator zip file into the program – open the TradeStation indicator zip file to get the .ELD files.

NinjaTrader Indicators TradeStation Indicators

Emini Dow Futures Day Trading Charts

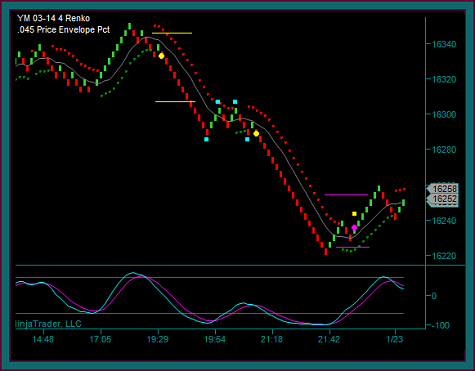

You are now looking at the YM 180 tick chart, and we will also look at the renko 4 brick chart that synchs with it.

Let’s now talk about some trade setups and related trade management for initial risk and profit targets. We will look at the renko chart for synch, but do note that there are renko trade setups at the 2 yellow circles on the tick chart.

YM 180 Tick Chart

Yellow circle1 – 180 tick chart price reject initial reverse:

- If we got a trade at 16330 and placed initial risk 4 points above the blue line at 16346 – the trade would have a partial target of the bottom blue line 16306

- That would be an initial risk of 16 points with a first profit target of 24 points – which would be fine as a ratio to take a trade

- The dow mini is $5 per point – so this is $80 initial risk and $120 for the first profit

- You can see what I meant earlier when I was comparing this to the emini russell

Yellow circle2 – this would be a 180 tick chart setup:

- 16306 price shift-reject to resistance

- Lower high retrace after 2 blue square double bottom, with mex flow

- Sell 16290 – if renko synch

The potential issue with this trade is the purple line at 16274, 16 points away as partial1 – compared to the yellow line area above the blue line:

- This would be at 16315, which is 25 points away – or you would go to 16311, which is still 21 points for initial risk

- However, there is very good breakout potential through the purple line, as a triple bottom and previous pmd low breakout

- The next price as support would be 16254 and a 36 point partial1, compared to the 21-25 point initial risk

- This would be fine, and also note that you have even more breakout potential at this target – again it would be a triple bottom previous pmd low breakout

- This trade could have had an extended partial to 16242 and 48 points

- Get a 2nd partial at the momentum extreme, which would be around 16230

- Then after the low and momentum extreme cross – exit your addon at the purple circle 16240

- Continue to trail your initial contract for the blue line area as resistance – unless the renko chart shows something different

Renko 4 Brick Chart

Yellow dot1: The yellow dot is a renko base trade setup – and this is what synchs with yellow circle1 on the 180 tick chart

- Sell the price envelope reverse midline reject with mex flow at 16332

- We have already discussed the initial risk and profit targets for the trade

- You can see what they would look like on the renko chart only at the yellow lines

Yellow dot2: Again we have a renko trade setup – I really like the renko brick pattern associated to the trade

- 2 blue square double top test of the yellow price line and the first profit target as resistance now

- 2 blue square double bottom

- Sell the yellow dot 16288 as a midline reject triple bottom breakout

- NOTE that the trade is actually with the mex rollback instead of with mex flow

- But this is with the 180 tick chart setup – and this certainly isn’t against the renko chart

Purple dot: The renko chart gives us a completely different look after the lows then the 180 tick chart – that purple dot is a renko base trade setup

- You could take that trade at around 16236 with the first partial target at the 16254 price discussed on the 180 tick chart – and initial risk at 16223

- The initial risk-reward would be 13 ticks to 18 ticks

- But not against a direction move like this and not having any price failure component as part of the setup – with 180 tick in sell mode

- The purple dot would be the addon exit

- And I would probably exit the initial sell at the yellow square, instead of holding all the way to see if the purple line would hold

I am going to end our first emini dow futures day trading video. I wanted to introduce this contract into our futures trading list, and give you the trading chart parameters.

Additionally, I wanted to discuss this first trading swing to answer a question, and to discuss overnight trading volume. I will be doing more trading videos and continue to be sure I feel comfortable with the tradeablility – the next video will also discuss my first renko chart emini dow day trade.

Be the first to comment