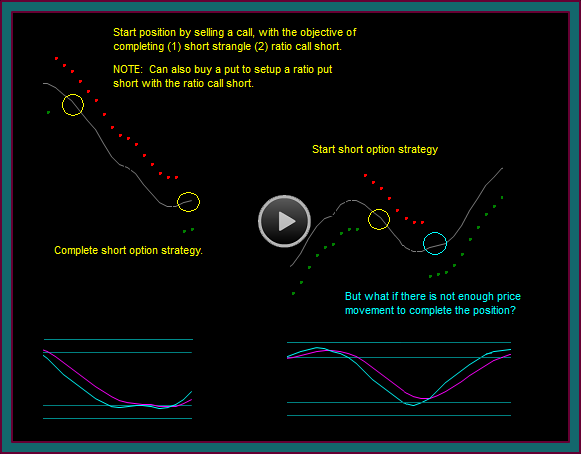

We ended our previous position trading video, about starting a position with a short option, with the following chart and question about short options trading protection:

What if you start your short strategy at yellow circle1, but instead of going to yellow circle2 and completing your spreads – you only go to the blue circle and reverse right back into buy against the short calls you just sold?

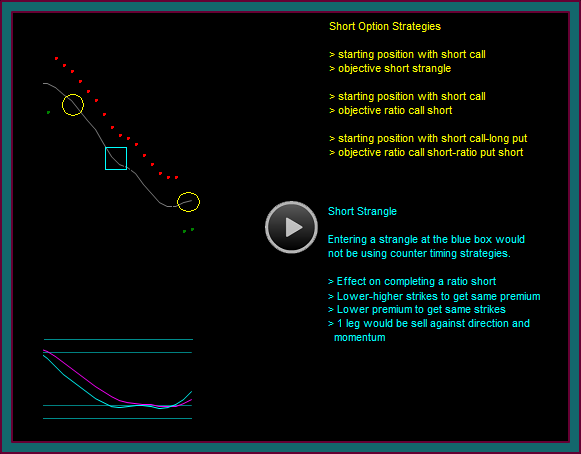

So, in this video we are going to discuss the timing for short options sells and protecting short option positions, along with doing a yelp stock and options position update.

Short Options Sell Protection

Looking at the chart from the end of the previous video and talk about short option protection trades.

- The scenario is that a position is started with a call sell at the yellow circle – so this begins as an uncovered options position

- And instead of moving far enough to complete a spread, there is an immediate resumption of the buy swing at the blue circle

- Which is also a renko buy setup with the position chart direction

So, the issue becomes whether a trader that primarily focuses on options selling strategies, should buy the stock as a protection trade.

- Technically the option doesn’t need to be protected at this point

- This might be a stock buy at 50, when the short option is the 52 strike and sold for 1.00

- But do you want to take the trade when you have a setup and not assume how far the swing will go

- Or do you want to possibly get no trade setup or have to buy the stock simply to protect the math of the position

- My thoughts are buying the stock when you can –vs- when you have to is the best tact – especially considering that these are high odds trades that would tend to be profitable

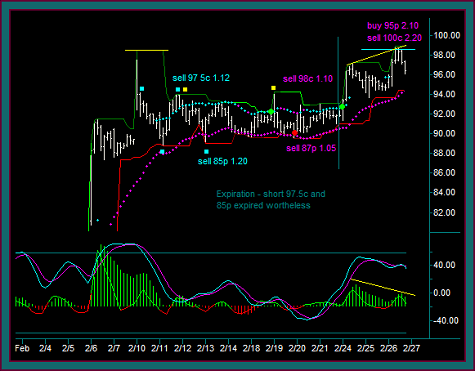

Yelp Position Trading 2/18 – 2/19

- Green dot buy: when this trade done it was read as a breakout of the 2 blue squares

- The trade would cover the short calls

- Short 98 calls at 1.10 2/28 expiration

- Red dot sell: instead the yellow squares held as a double top and I was quickly out of the trade

- 91.90 buy 94.10 partial and a 90.60 trailing stop made the trade a net loss

- And the sell was done into the 2 blue squares triple bottom breakout – and went nowhere = 90.85 sell and 91.95 exit

- Short 87 puts at 1.05 2/28 expiration

- NOTE: the short 97.5 calls and 85 puts expired 2/21 – this is the vertical line and you can see that the short strangle did expire worthless

- The short strangle profits with the partial on the buy did give a slightly profitable net trade

Here is the renko chart related to the 2 stock position trades and the timing for the 2/28 expiration option sells – the blue square is the exit of the yellow circle sell.

NOTE: There was never a call buy done to give synthetic long protection to the sell – there was really nothing to protect at that point and instead of taking away from the short call credit with a call buy, I just exited the trade.

Yelp Position Trading 2/24 – 2/26

- Green dot2 buy 92.62

- Here is a good example of protecting the short options when you can –vs- when you have to

- What if either of the previous trades had continued like green dot2 – what would you do to protect the short calls

- The previous protection trades weren’t needed – but look at how much room the triple breakout had to the high or back through the earnings reaction

- Here is a good example of protecting the short options when you can –vs- when you have to

- Resistance double top pmd high combination

- The short strangle gave me an upside breakeven of 100.15

- I also had enough stock to cover the short calls after a 98.65 partial if there wasn’t a retrace after the resistance reject

- Sell 100c 2.20 3/7 expiration

- And this time with a good profit in the stock, I also wanted the synthetic options protection and bought a 95 put at 2.10

The objective now on a retrace, would be to try and pick a call buy and put sell to complete 2 ratio short spreads.

Since we were again moving directionally but had rejected resistance, I wanted the wider breakeven and risk-reversal profit potential of the ratio spreads –vs- having a short strangle options position.

Be the first to comment