Options Credit Spread Adjustments On A Gap Open

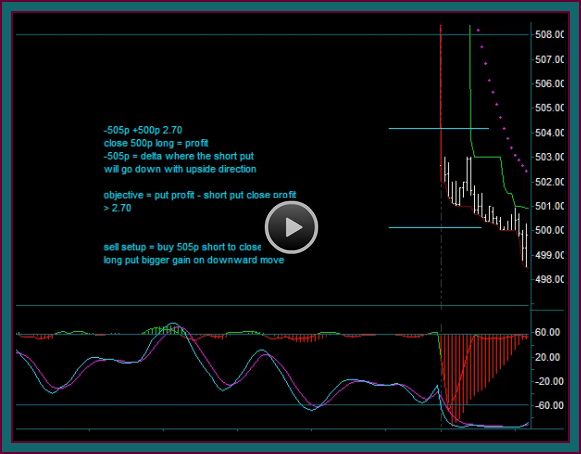

An options credit spread combination put leg goes into the money on a large gap down – how does the risk-reward change, and what adjustments can be made through trading. The video also discusses some ‘base’ method setups for underlying trading – and whether they were also done as option trades.