Yelp Stock And Option Position Trading Update

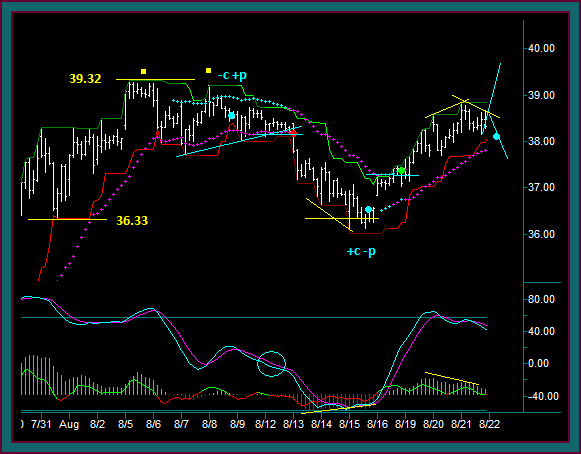

In this yelp position trading video, I am going to do an update on the yelp trades done from 3-18 through 3-28. A couple of the key decision points in the video are: (1) why ratio call spreads were done in one case but not others (2) a renko trade that was counter momentum on the position chart and projecting the price of a price momentum divergence.