Making options spreads adjustment trades, by closing option legs with trading method setups, can increase the overall profitability of the spread.

When you trade into a vertical options spread, regardless of whether it is a long or short spread, you have a maximum profit and maximum loss. Being able to know your risk reward in a trade is one of the benefits for trading options spreads.

But having a maximum profit also puts a cap on the amount of money you could make on a directional price move after you have completed your spread. For instance, you are long a 50 call for 2.00 and trade into a short 55 call for 1.50, using a trading method buy setup for legging into the trade.

This is a great price, considering that you have traded into 5 point width call debit spread for only .50 – meaning that you can now make a maximum profit of 4.50, with a maximum loss of .50. We certainly can’t complain about risk reward like that.

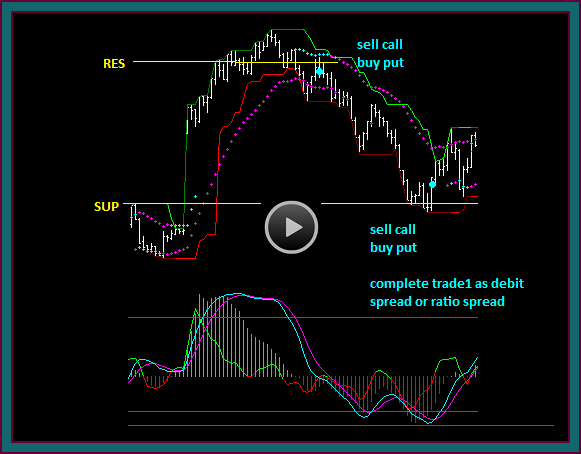

However, after the spread was completed there was the following price action:

- Retrace from 54.60 resistance – there is a sell setup at 54.15 that went to 51.50 support

- Support holds followed by a buy resumption setup at 51.75

- The buy then goes through 54.60 to 55.85

The call options spread maximum profit is attained at 55, and it remains the same regardless of how high the underlying goes.

Consider the following options spreads adjustments that could have been made, using the price action described – compare this to closing the spread on the sell setup and taking a profit:

- You sold the long call for a profit on the sell setup – and held the short call

- You bought the long call back on the buy setup – along with closing the short call

- You then resold a call again, but now at the 56.5 strike, to complete a new options spread

Options Spreads Positions Adjustments

We will go into the options trading worksheet to look at the impact of the adjustments to our options spreads. This will give us a good chance to see how the GreeksChain worksheet will be used.

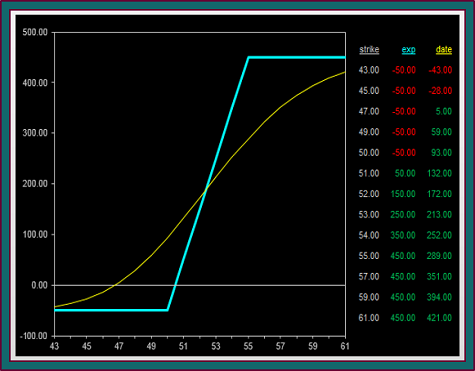

Using the OptPos worksheet to enter the position and get a profit graph to expiration, as well as the scenario date, I get the following:

- Maximum profit 4.50 at 55.00 and higher

- Maximum loss of .50 at 50.50 and lower

- Current profit of 2.58 – based on the options theoretical value prices

Now let’s go into the GreeksChain price worksheet and take a look at the options adjustments trading scenarios:

- The theoretical value of the long call has gone to 4.62 – close this for a 2.62 profit on the 54.15 sell setup, and hold the short call

- The resumption buy setup is at 51.75 – adjust inputs

- 51.75 underlying 52 ATM option – change date to next day and leave volatility the same

- This time buy the 52 call – theoretical value is 1.65

- Close the short call for .64 theoretical value – gives a profit of .86

- You are now net long the 52 call

Price goes through 54.60 to 55.85 and there is a pmd high.

- There is no sell setup and there could be a pmd failure, which is a swing continuation setup – but with this much movement and profit, sell a call and turn your trade back into a long call spread again.

- Again change the spreadsheet inputs

- The move from the 51.75 move to 55.85 took 2 more days – so change the date input accordingly

- 55.85 underlying 56 ATM – leave volatility the same

- The theoretical value for the 56.50 call is 1.50

- You now are long the 52 call 1.65 and short the 56.50 call 1.50

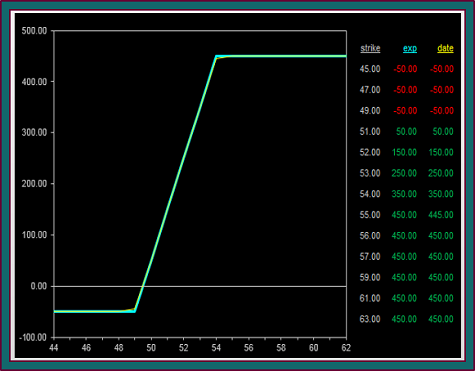

Let’s look at what we have been able to do with these adjustments – let’s first look at the new profit graph:

- Maximum profit 4.35 at 56.50 and higher

- Maximum loss of .15 at 52.15 and lower

- Current profit of 2.66 – based on the options theoretical value prices

Additionally, compare the profits gained and increase potential from using trading method timing setups for exiting and entering options legs in the spreads – to the existing spread with no adjustments made, assuming a 56 expiration:

- The original spread makes its maximum profit of 4.50

- The spread adjustment trades + the new spread makes a profit of 7.33

- The 2 options legs that were closed made 3.48

- The +52 -56.5 call spread expired at a profit of 3.85

- 52c 4.00 intrinsic value – 1.65 cost = 2.35

- 56.5c expires worthless = 1.50 profit

Trading Method Combination Strategies

NOTE: our actual trading strategies for a move similar to this would include stock options combination trading:

- The trade setups would have also been stock trade with the options trades

- Puts would have been bought when the calls were sold – against the long stock

- Puts would have been sold when the calls were bought – against the short stock

For the purpose of discussing the potential profit increase by making adjustments to options spreads with trading method setups – assuming that the option strikes have enough delta to be relevant to the stock price moves, we are just looking at the call spread.

This kind of 2 way movement definitely happens. Facebook recently has gone from 52.09 to 45.73 and then back to a 49.57 swing high – there were some terrific trades and opportunities to trade out of existing option spread legs and then back into spreads again.

And certainly there are times that a swing immediately resumes after closing an option. Of course if you were still long or short the underlying your overall position would be fine. Or there are times that you get price movement, but not all the way from resistance to support or not back to resistance again.

But when all things are considered, options spread legging, along with trading in and out options spreads legs, can increase the overall profit of the spread position.

Be the first to comment