We are going to discuss options position trading and the ratio short spread strategy, specifically we will talk about the timing for setting up and completing the ratio option spread.

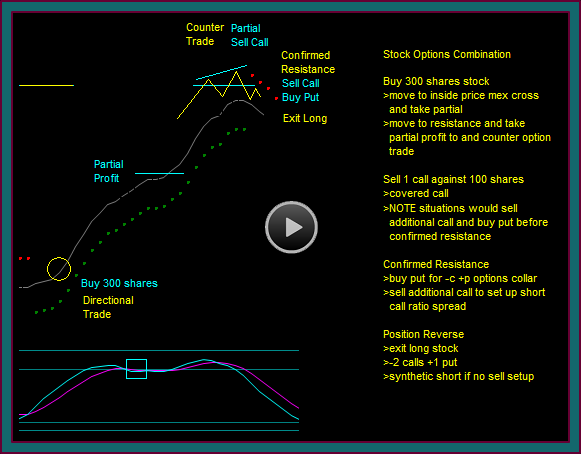

I am going to start with the same stock and options combination position from the previous video, but now do this in the context of the following position changes:

- We will begin the position by buying 300 shares of stock instead of 100 shares

- We will sell additional calls after resistance to setup a ratio short options call spread

- And then we will discuss the completion of the ratio call short and a ratio put short, after a price move down that is followed by a renko price envelope reverse

Counter Option Trades At Resistance

The buy was a basic renko trade setup in the direction the position chart, marked directional trade. Let’s review the counter option trades that were done after moving to resistance:

- Purple Square1 – Sold a call against the stock

- A put was not bought at the same time, because of the potential from a pmd failure, which is a continuation trade

- Long stock + short call = covered call – this is a trade that will put a cap on profit above the short call strike price + what the call was sold for

- But there is no further risk from the short call because it is covered

- And if you don’t want the cap issue, you could do a pmd failure addon setup of 100 shares

- If we bought a put and there was continuation, the purchase would be unnecessary and it would use up a portion of the short call credit

- Purple Square2 – Confirmed resistance

- We waited for confirmed resistance before buying the put

- It was needed at this point to protect the long stock, because the odds of reverse had been increased

- Short call + long put = synthetic stock short

- This will hedge part of the retrace – in the previous video, we saw that this amount was around 70% from the strikes that were selected

- Position chart reverse from buy to sell

- Synthetic short now acts like a stock short

- This is especially useful if the reverse isn’t followed by a trade setup

Now let’s begin the stock buy with 300 shares of stock and talk about how the trading changes when you can taking partial profits, along with overselling calls.

- Buy 300 shares of stock

- Partial profit at inside price mex cross combination

- No price envelope reverse – and didn’t do any options trade

- NOTE: This is very possibly a pmd high too – giving a pmd failure addon setup, which would have been especially useful if you had also sold a call

- Price goes to chart resistance

- Take another partial profit

- Sell 1 call against remaining 100 shares of stock after pmd high-price break

- Confirmed resistance

- Buy put to create options collar against long stock

- And sell 1 more call – the extra call is to set up a ratio short

- NOTE: There are times that I would sell both calls and even buy the put after the pmd high and price break

- For instance, if that was a support-resistance shift line reject from a bigger sell swing

- Always keep in mind that the extra call sell is uncovered and the put buy is a cost – we want to do this with the highest possible odds of reverse

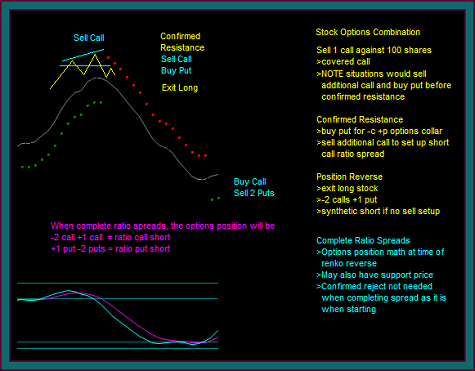

Setting Up Ratio Short Spreads

The counter options trades that have been done, now make the stock options combination +100 stock -2 calls +1 put.

This has been done with timing that we view as having high odds for a position reverse. But be sure you understand that the 2nd short call is uncovered and the position may resume the buy swing, which could also happen even if there is a position reverse.

Additionally, after the +100 stock is exited, you will be short 2 uncovered calls instead of 1.

Before doing an uncovered options trade

- Be sure you understand short options risk and math

- Be sure you know how to protect the trade

- I want to use an addon trade for protection and covering the short option –vs- taking a stop and creating a losing trade

- I would also say that the more comfortable you are with addons and protection trades, the earlier you could sell your extra options, which would give you a better credit

- For instance, if you sell 2 calls after the pmd high and blue line reverse, you will get a better credit than waiting for confirmed resistance

- But a pmd failure is a continuation and addon setup – that will protect the uncovered call

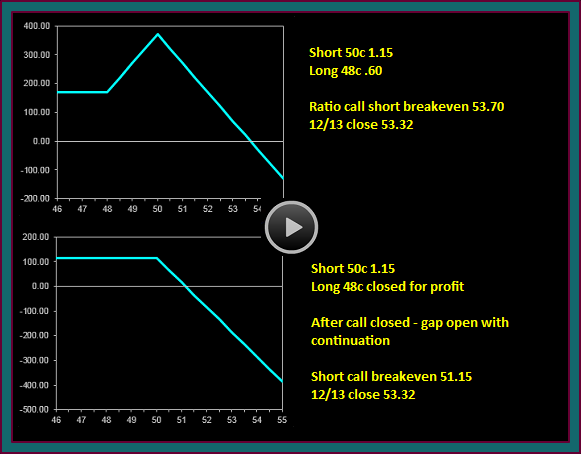

Completing Ratio Short Options Spreads

The objective now is for a position reverse to go far enough down, where we can complete a ratio call short and ratio put short.

For this specific trade, we are going to assume that there was no short stock setup after the reverse [we will do another video where we have a position with these options trades and short stock]

- The timing to complete the ratio spreads is the price envelope reverse

- NOTE: we may also have a support price reject, but it’s not necessary like it was when we began the options position

- Completing the spread is a combination of timing and position math

- We want the biggest possible spread width at a credit that is possible

- Ratio spreads are still uncovered trades – but they have a lot less risk than short options only, and this risk decreases as the spread width increases

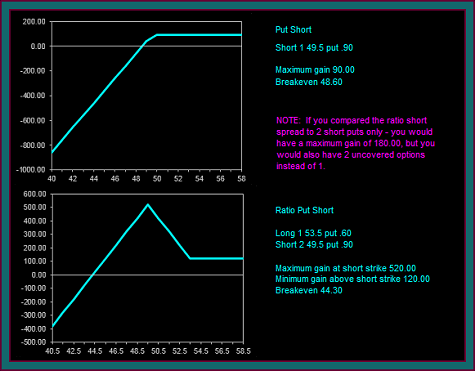

Ratio Short Options Position Profit Graph

We have now discussed setting up and completing the ratio options short spreads.

I am going to end this video comparing the position profit graph for short puts only to a short put ratio option spread:

- 53.5 put buy .60 on the confirmed resistance reject

- Renko price envelope reverse sell 2 49.5 puts .90

- Gives 1.20 credit – minimum gain if expiration above 53.5

- Maximum gain 520.00 – occurs at short strike

- Breakeven at 44.30 – the low price before the 50.00 stock price was 48.80

- Short strike – spread width – credit = 49.5 – 4 – 1.20

- NOTE: This spread width is bigger than average trade, but these are real numbers and a function of the swing traded

In the next stock options position trading video, we will discuss the position profit graphs for a number of different scenarios:

- Put and call short ratio spreads with no stock short

- Put ratio short with call short only if no short stock

- Put and call short ratio spreads with stock short

Be the first to comment