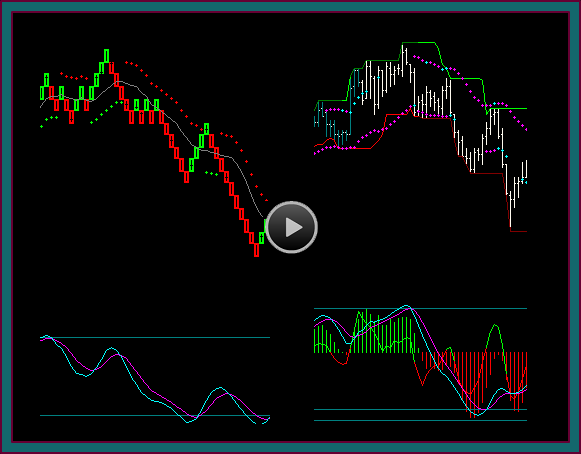

In this video, I want to do a renko chart trading strategy reference discussion for position trading stock and options combinations, and how the renko chart setups are being used for timing.

So, we are going to focus on renko chart position trading strategy scenarios, based on the following:

- What direction is the position chart

- What is your position trading plan

- Trading the stock and options in combination

- Options selling strategies

- Do you primarily want short strangles or do you want ratio short spreads

- Underlying protection trades

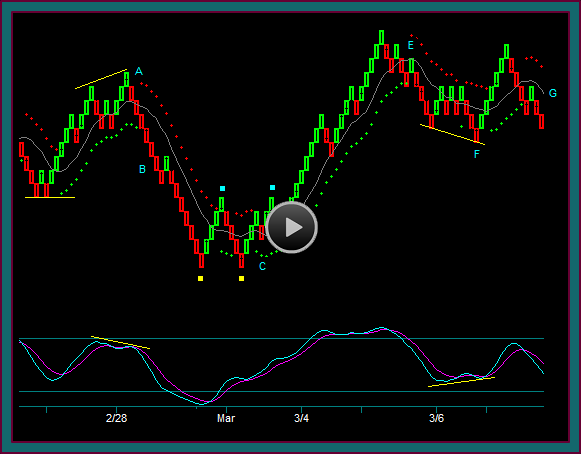

To begin with, let me make some notes about this renko chart if it was a day trading chart:

- The left yellow low was a retrace higher low –vs- a support price – it became relevant from the 2 blue squares double top price action

- B D E G – are all renko base setups with profit components that would be done as day trades

Renko A

- If position chart has remained long

- Long stock – sell call and buy put

- Long call – spread into ratio call short

- Sell call – new position

- Short put – hold as short only or buy

- If position chart reverse syncs with price envelope reverse

- Exit long stock

- Depending on option trades done – you are now short calls or short options synthetic

Renko B

- If position chart in sell

- Short stock

- There would be no options trade here unless using short call-long put as stock replacement trade

- NOTE: this setup is a continuation trade basis the renko reverse – these trades assume that they aren’t being done into support, without partial room

Renko C

- NOTE: yellow square-green brick high is a shift line resistance reject – which is going to affect the options trades that are done

- After double bottom and midline break

- Short stock – sell put

- Long put – depending on expiration you can exit for profit – with time you can complete ratio short

- Short call – can complete ratio short

- You can also complete a short strangle but be aware of a resistance reject and triple bottom break that would entail a stock protection trade

Renko D

- Again, trading decisions have been made because of the shiftline – if not, the trades would have been done with the renko buy setup after the double bottom

- Stock short being held for resistance and with synthetic protection

- Exit short

- If position chart has reversed – buy stock

- Short puts-long call would be a stock replacement trade

- If short strangles trading and never sold puts – sell puts against A short calls

- NOTE: if position in sell but ‘close’ to reverse – I would go long instead of exiting only

- This is a function of the resistance failure break and left side diagonal breakout potential

Renko E

- This is a very good renko trade setup that includes the failure of the A price high

- BUT with the size of the buy swing, it is unlikely that the position chart has reversed

- Any long trade should be protected

- Long stock – sell call-buy put

- Long call-short put from C-D – can complete ratio short spreads if long call has time AND if not then can take profits

- Sell more calls – but if short puts only and this is a short strangle, then be prepared to do protection trade if not continuation down

- Any long trade should be protected

Renko F

- PMD low – but not related to any price

- There is no setup for any options trade – I would consider completing a ratio call short

- The trade would be based on spread arithmetic and begin able to get a credit at the pmd low

- Or if this was Thursday and a long put was profitable – I would look to take the profit

- I would be comfortable with a short put breakeven at this point

Renko G

- Lower high and another renko base setup – including breakout potential through the previous pmd low

- Basing decisions and ‘modelling’ to the yellow line-blue square shift line

- If position chart has had mex cross and approaching reverse – would do short stock

- Selling calls – this would be a function of day of week

- For instance if this was Thursday and could sell a new call at a higher strike than E for around same credit – I would do this trade

- If took profit on long put at F or it was expiring – I would buy new put for following week

My position here would be:

- Short stock OR short call-long put and flat stock

- This is dependent on position chart

- But with breakout potential and support location, I do not envision that a long stock trade would be held even if one was held after E

- Short call and short put

- Depending on expiration of the long options – I would be in ratio short call and put spreads instead of short strangle

Be the first to comment