In our last facebook position trading video, we discussed a short call option trade that had gone deep in the money. But because the facebook short call was part of a combination position, with long stock and at one point a long call, the overall position was profitable.

Facebook Short Call Option Trade Goes Deep In The Money

That video had taken us through the 12/13 close, but the short call had a 12/20 expiration. So, in this video we will discuss the following trading week – looking at any additional trades that were done, along with how the facebook short call and stock position ended up at expiration.

Facebook Long Stock Short Call Position

By the 12/13 close there was a facebook stock and options position that included:

- The initial facebook stock buy

- 2 facebook stock addons

- 2 short calls

- And as discussed, the short call that had been a ratio spread lost the expanded breakeven range and partial short call cover, when the long call in the spread was closed for a profit

- The 2nd short call never had a retrace that allowed for it to be traded into a ratio spread

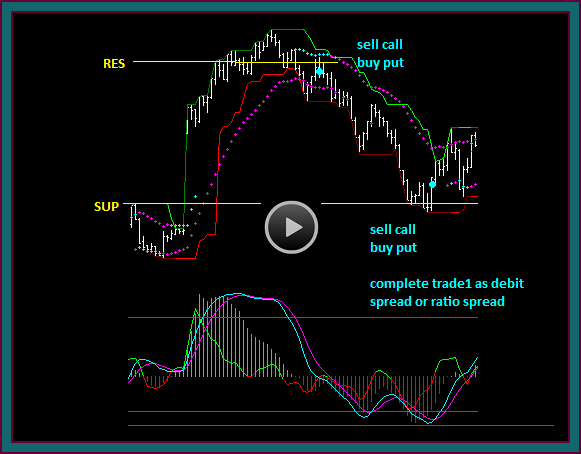

But we know that a facebook long stock short call combination is a covered trade. It does however cap the amount of profit that the trade can make.

For instance, look at the math for the long 49.10 stock -50 call 1.15

- The stock is called away at the short strike 50 = .90 profit + 1.15 from the short call = 2.05 profit

- Add the profit from the long 48 call in the ratio spread = 1.90 + 2.05 = 3.95 profit

- The profit also doesn’t include the puts that were sold and will expire worthless

So, by comparing the 53.32 12/13 close to our overall profit, we actually haven’t given anything up to that point.

I continue to emphasize this point, because it so critical to the protection and management for our short option strategies – and especially in the context for traders that may short options only and never do the combination trades.

Facebook Stock Price Movement 12/13 – 12/20

However, the short calls don’t expire until 12/20. So, let’s look at the facebook price movement from 12/13 to 12/20, especially looking for:

- Anymore stock addon setups

- We would have of course looked for stock sell setups real time too, but they were never an issue during this trading period

- This is important for a couple of reasons: (1) I am going to lose all of my stock at this point, because it will be called away (2) I won’t have stock to sell any more calls

- Anymore short call setups

- And if additional calls were sold, was there ever an opportunity to do a ratio call short to increase the breakeven and profit potential –vs- a long stock short call combination

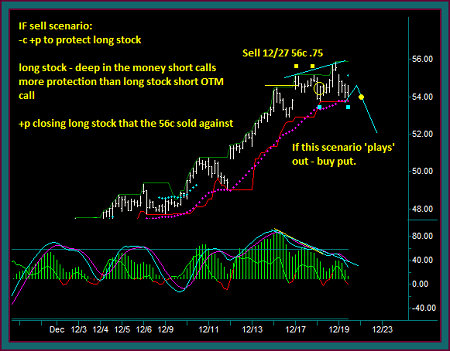

Facebook 60 Minute Position Chart

- Double top-falling momentum – synchs with renko chart price envelope reverse

- Sell 12/27 expiration 56 call .75

- Although I have some of the initial facebook stock buy to sell calls against – I really need a retrace that is big enough to do a ratio call short, or I will have short calls that are uncovered

- Pmd high-pmd counter point double bottom

- Looking for the blue line-yellow dot scenario to move back through the left side

- If this scenario happens, I would buy a long put to combine with the short call and protect long stock

- And now we are back to the original facebook chart that we looked at

- The sell scenario that we looked at never happened

- There was never a facebook buy setup after the 12/18 price momentum divergence high close – 12/19 small gap down open

- The pmd counterpoint double bottom held – but no buy after that

- Into the 12/20 close – buy 12/27 facebook 54.5 calls 1.00

- This gives a call ratio short to cover any short calls that were not covered by stock

In the next video we will go into the following week and again look to see if there were any facebook stock setups, especially buys if there is no sell setup that completes. And we will discuss the math for the existing facebook stock and options combination position.

Be the first to comment