In this Facebook stock and options position trading video, I am going to do an update from 1-17 to 1-27. This is an especially important time period, because it will include preparation and decisions for trades that can be held for Facebook earnings on 1-29.

From 1-9 to 1-17 there was really very little trading going on. There was a Facebook stock sell on 1-13 that got a partial profit at support, before a reject reverse that didn’t have a buy setup to trade.

There were short 1-24 expiration 55 puts and 60 calls that expired worthless, with the high after the 55.38 low holding at 59.31 – now let’s look at the Facebook renko chart and 60 minute position chart.

Facebook Position Trading Update 1-17

Yellow Circle: facebook stock sell 57.12 – and I was flat at the time, because after the last sell to 55.38 and back into buy mode, I never had a buy setup before the chart went into consolidation.

- I was already short 1-24 60 calls from 1-13

- Without an open buy – I did not buy a put to have a short option synthetic for protection before the position reverse

- Facebook went to 56.07 with momentum building instead of extreme – and at the point I never turned the short calls into a ratio short with a long call buy, nor did I sell any puts

- And I never got a partial profit – the trade was a total loss, with a 58.08 exit

- Additionally, there was no buy setup to go long on the move to the 59.31 chart high

Facebook Position Trading Update 1-22 To 1-27

Yellow Dot: facebook stock sell 57.23

- At the time of the trade mex had crossed and there was a dc dot shift – momentum was right near 0

- So I read this, synched with the renko trade setup, as the initial reverse and went short

- This was also the time to try and take advantage of the implied volatility increase, as we were approaching the 1-29 earnings

- Sell 2-7 expiration 62 calls 1.95 – and again with no stock buy that I wanted to protect with a synthetic short, I didn’t need to buy puts

- But if we could at least get to 55.38 support – I should be able to get a good 2-7 expiration put sell to complete a put ratio short

- 1/31 56 puts 2.38

- Normally I would look to buy 57 or 56.5 puts, with the stock sell

- Again this was the issue with the options implied volatility ahead of facebook earnings

Blue Circle: renko buy setup at 53.43 – note that this support point kept the blue dot from being done as an addon, because the trade wouldn’t have profit room

- I wouldn’t do the blue circle buy against the position – but this is an excellent options setup

- Buy a call and sell a put as synthetic long protection for the trailing shorts – especially important in this case because of the current room before the position reverse

- The call buy would also complete the ratio call short for the short 62 calls

- The put sell would complete the ratio short with the long 56 puts

- Except the blue circle is 3:04am and the options aren’t open

- What I had actually done is the call buy and put sell on the mex cross and 2nd green brick

- The math was definitely there to use this timing

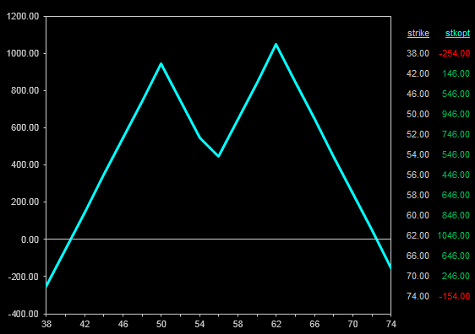

Facebook Ratio Option Shorts Position Profit Graph

Let’s look at the Facebook ratio short options positions that will potentially be held through earnings:

- Buy 1 1-31 expiration 55 calls 1.90 – for each 2 short 2-7 expiration 62 calls 1.95

- Breakeven is short strike + spread width + credit

- 62 + 7 +2 = 71

- Sell 2 2/7 expiration 50 puts 1.92 – for each 1 long 1/31 expiration 56 puts 2.38

- Breakeven is short strike – spread width – credit

- 50 – 6 – 1.46 = 42.54

- And then to each of the breakeven points you would add or subtract the credit from the other side

- Call breakeven 71 + 1.46 ratio put credit = 72.46

- Put breakeven 42.54 – 2 ratio call short credit = 40.54

I will decide before earnings, based on the stock price and the room to each of the short options breakeven points – but I expect to hold both of the ratio option short positions, and take my short stock profits and go flat.

Be the first to comment