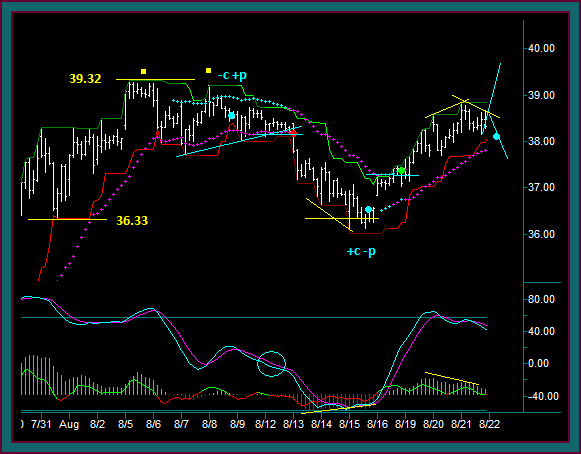

Yelp position trading, using renko chart trade setups, has been added as an underlying for our stock and options combination trading strategies. The initial yelp trades were discussed in the 1/9 and 1/10 facebook trading update video.

I now want to go forward discussing yelp trading, with a trade update for 1/13 and 1/14 – and especially how we combine the 60 minute position chart with the renko chart setups for timing.

Yelp Stock And Options Position Trading

You will remember that the current yelp stock and options position on 1/10 included the following:

- 1/6 long yelp stock at 69.22 with a 70.30 addon

- 1/9 sell 1/17 82.5c 1.75 buy 1/17 80p 2.10

- 1/10 long yelp 78.75 on a swing resumption trade with a 80.28 addon

Remember the implications of the 1/9 1/10 trades

- The short options synthetic was done as protection against long stock

- It was then a short stock equivalent if the stock was exited on the renko price envelope reverse

- The resumption buy was then a hedged trade with the profit curvature discussed

- Min gain of 90.00 regardless of how low the stock went

- Max gain of 340.00 – the stock cap price is at 82.50

- I closed the 70.30 addon but held the trailing shares from the 69.22 initial buy

- This could have been done because the 60 min position chart remained in buy and there was the synthetic short protection

- This was part of the stock hold decision – the exit would have also been at price support, which I didn’t want to do

Yelp Position Trading Update

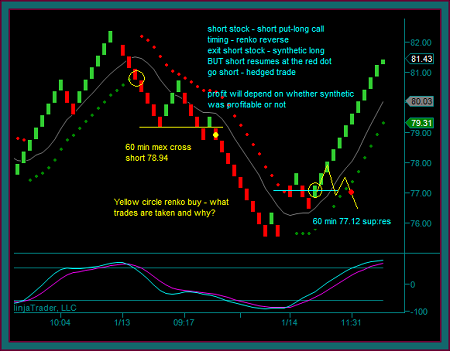

Here is the 60 minute position chart for the 1/13 and 1/14 period we are going to discuss and where I marked the options trades that were done. I am going to go over these on the yelp renko trading chart that was used for additional timing.

1/13 Yelp Trading

Yellow circle: you can see the renko price envelope reverse, which synched with the 60 min pmd high and break through the previous high area, instead of holding it as support.

- There was no consideration of going short on the renko reverse, like was done for previously going long

- The difference is the buy was a resumption of the 60 minute position – where a sell would be against the 60 minute position

- Sell 1/24 85c 1.80 – this is a covered position against long stock

- Already long the 1/17 80p which has never been spread – it was held to hedge the resumption buy as discussed above, since it was done as a support reject but also with falling momentum

Yellow dot: renko continuation sell setup – midline reject and previous low break2 with mex flow

- The timing of this short was at a point where the 60 minute reverse was going to happen, if there was any continuation through the left side

- So this is the point where I would want to be flat the stock, but did this trade as a short

- It was first done as an exit and day trade – and then with the movement down and the yelp position chart reverse it was held

- Short yelp 78.94

- Short 1/24 75p 2.20 – currently covered by short stock and long 80p through 1/17

- Is this trade simply a spreading opportunity after a directional move down – or is there something else?

- Selling the put on the close after this size move would ‘always’ be fine

- But this is a key support price – testing the 10/21 price high 75.37 now as support

- The combination of these 2 was why I did the trade – and with the stock covering the short, it would have been good timing for closing the 80 put and taking the profit

- I held it though for a down first open on 1/14 – didn’t work out

- Is this trade simply a spreading opportunity after a directional move down – or is there something else?

1/14 Yelp Trading

Yellow circle: This is a very good renko base trade setup that includes the price failure component of the blue line – that is the 77.12 price and a support to resistance price on the 60 minute chart

- And as a position trader I can’t take this trade – if the reverse was imminent like the yellow dot sell or if I was day trading, then I would take this buy

- Trading decisions that were made, especially with the gap reaction to the 75.37 support price

- Close the 2.10 80 put at 4.10

- Buy the 1/17 77.5c 2.40 – which completes a short call ratio spread

- But at this price location –vs- the 85 call strike for the short – the long call with the put short from 1/13 is most sensitive as an options synthetic long

- Close the trailing 78.94 sell at 77.25

- NOTE the timing of these trade – close the put after the open

- Close the stock and buy the call on the renko buy

That ends this yelp trading video with a position after the stock was closed being a long options synthetic – if there had then been a price swing failure instead of the continuation we got, then I would have looked for a re-entry to the short.

There was never a buy setup to use to add a long stock position, so the participation comes from the synthetic long.

Or was there a stock buy setup to do?

Think about this further and what the trade may have been – and we will discuss this when we do the next yelp stock and options position trading video.

Be the first to comment