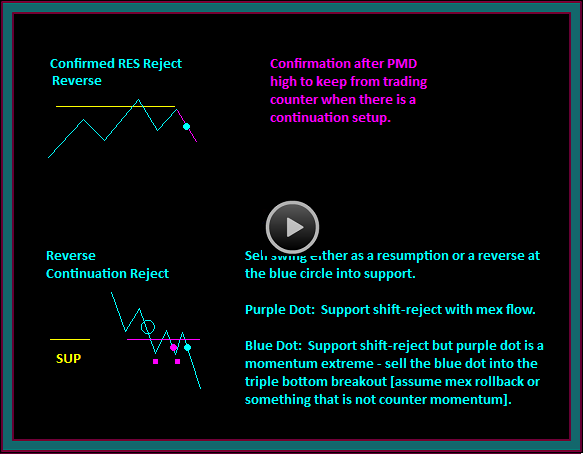

Price Reject Continuation Trading Chart Pattern

In contrast to a confirmed resistance or support reverse pattern, the price reject pattern is intended to give a continuation trading setup. The pattern would occur after an initial reverse went through a price point that rejected and continued the current swing – for instance break support and then have it shift to resistance and reject, continuing the sell direction.