Short Options Risk

The Trading Risk From Selling Short Uncovered Options

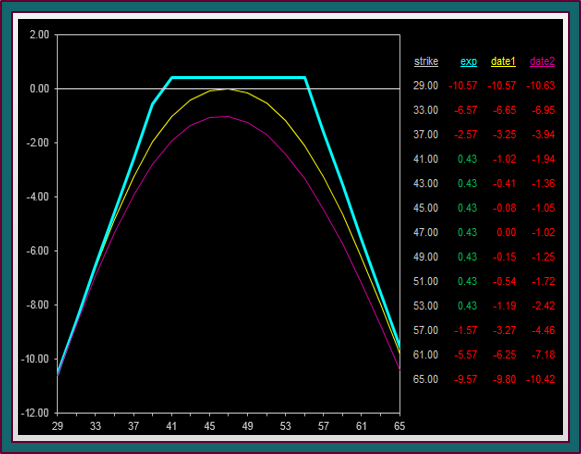

Selling cheap uncovered short options strangles that are multiple strikes out of the money may seem like an easy way to make money, because of the supposed likelihood of the trade expiring worthless. But it is a trade with terrible risk reward and may be a lot riskier than would appear from the short strikes location.