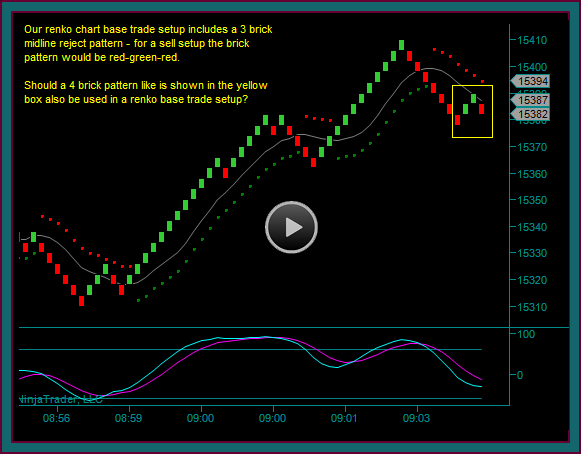

This emini dow day trading training video, will be a renko chart trade setup and review. And we are going to start by talking about a potential trade setup that has a 4 brick pattern, and discuss adding this to our renko base trade setup.

Additionally, the video will discuss trade setup filtering for price and momentum, along with a renko consolidation breakout setup.

Price envelope reverse and multiple brick move without a setup. We have now retraced back to the midline and have a reject brick and reversal brick, with mex flow – is this a renko base trade setup?

- Your immediate answer may be no, because there is a 4 brick pattern instead of 3

- I want to include 4 brick patterns like this as a base setup – but I want to make some additional notes about trading the pattern

- When you chart read for what is happening, you can see that the price envelope reverse then retrace, comes from a test of previous resistance as support price

- My concern from this point is that the next brick[s] are green and start a resumption of the left side buy swing – especially considering that it is testing support.

- So, for a renko chart entry, I want to see another red brick breaking the yellow-blue line

And be sure to look at your 180 tick chart for the relevant price that was tested and needs to fail for continuation

- The yellow price line is what is being tested when the blue line hits and rejects

- Red dot sell: In this case I want to be sure that my trade entry is a failure of the yellow line-using the blue line break2 for entry

- And we have that situation with the initial price break of 15384-15379 to 15378

- Sell the 15384 price break2 after the retrace bar with mex flow would probably fill 15382

- 15382 was the renko price – and I still decided to wait for the next renko brick and entered the trade at 15380, but I probably didn’t have to

The main point is use the 4 brick entry pattern and another confirming brick, unless you have a situation on your 180 tick chart where you have a clear price failure entry to use without waiting

The partial target is 15362 which syncs with price on the 180 tick chart

- With mex still flowing at the first hit of the target, which is only 18 points, I held off – and then at the 2nd hit I went ahead and took a 15364 partial

- This partial was 16 points and smaller than my typical partial, especially with the expanded partials – but price is price, and this amount was accept when the trade was taken

- Management now becomes about wanting to keep a winning trade from becoming a loser and trying to hold the breakeven area – with 3 contracts unit size, there are 2 trailers against only 1 partial

- Price does go lower and now I want hold the 15362 area – it’s apparent that the chart would reverse around there, so the trade would exit as a winner if that happens

- Do not trail anything back to breakeven – be sure to adjust your profit trails as key price points break and your trade progresses further

- Question: Do you see a sell addon alert, with the same 4 brick pattern as the initial trade?

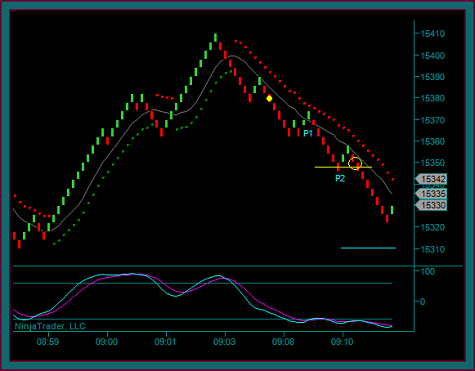

Renko 4 Brick Addon Trade Setup

Yes, it’s the same pattern, but I can’t do a trade against the mex extreme cross – and this is also support and the next profit target.

- Since this is a momentum extreme mex cross at support, an addon would be read as being into a pmd low

- And instead became another partial

- Actual price was 15348 and the renko brick price was 15346 – price went to 15345 and filled a 15347 partial

The addon would have worked fine and I would have definitely liked to have it, because now on another 26 point move down I don’t have a partial to take based on 3 contract trades

- If I did the addon partial1 would have been taken on the last green brick of the chart

- The blue line is next support and management becomes a risk reward question – how much give back are you willing to incur before going to another target 12 points away from this swing low

- At this point I am going to hold with the price envelope, which is actually more giveback than the distance to the target

- But we could always go to support and not reverse

- These last contract management decisions are very difficult

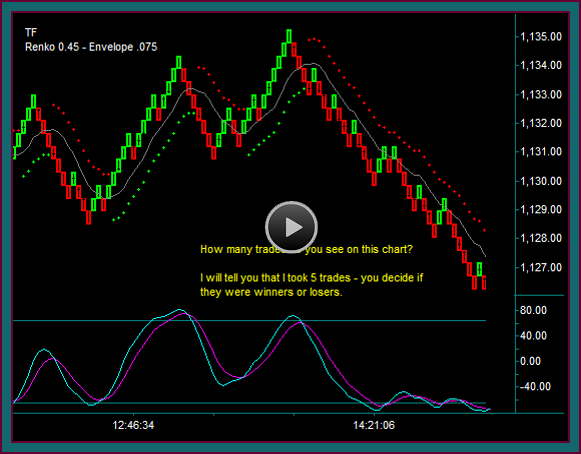

Renko Chart Consolidation Breakout Trade Setup

The price envelope always holds, and when we went down again I moved my trail above the green brick at the purple square

- We actually went to a support test pmd low and consolidated

- For management at this point and how profitable the trade has become – I would have no issue with anyone going flat after the pmd

- I decided to hold inside of consolidation, ignoring the price envelope reverse and instead watch the consolidation high that held as a double top

- We continued to consolidate, without being able to break through the 15310 support – but look at the formation that developed

- 15310 double bottom followed by a lower high midline reject

- We have our red-green-red brick pattern and the midline reject is with mex flow – and we also have a triple bottom breakout

- Sell the yellow dot as an addon at 15308 as a consolidation and support failure break

- Partial 1 was taken at 15288 after the green brick midline break

- NOTE: Addons are important to be able to continue taking partials after only having 1 contract left

- And as I have mentioned before, I am fine if someone does a 1 contract addon to be able to partial and continue trailing the initial

- Also don’t take the attitude that price has gone too far to do an addon

- This trade is at 15308 and got a 20 tick partial – the initial trade was at 15380 and only got a 16 point partial

- When these big extended moves continue break through support or resistance, with momentum builds and breakouts – they often continue to accelerate the move

- Short 1 unit of 15380 and 2 units of the 15308 addon

- Watching for the price envelope reverse to exit the addon if we don’t get continuation down – and then give the initial a couple more bricks of room

- I don’t want to hold for a 15310 test from this point – I would rather be flat and if it then goes there, look for a reject resumption setup

Be the first to comment