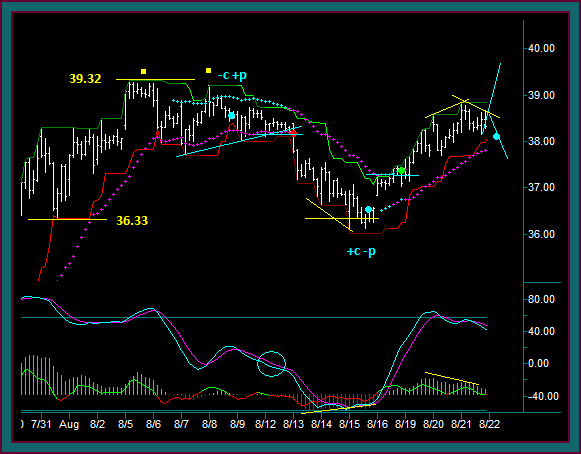

Trading Strategies For Stock And Options Combination Trades

By trading a method made up of a combination of stock and option trading strategies, the risk reward and overall profitability can be increased for the stock trades, as well as for short options trades.