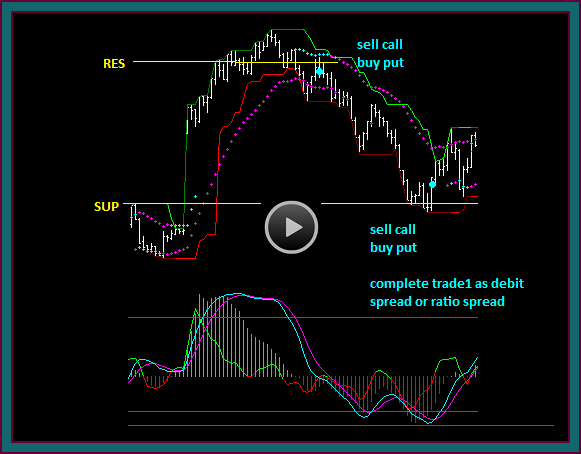

The Trading Risk From Short Option Selling Only

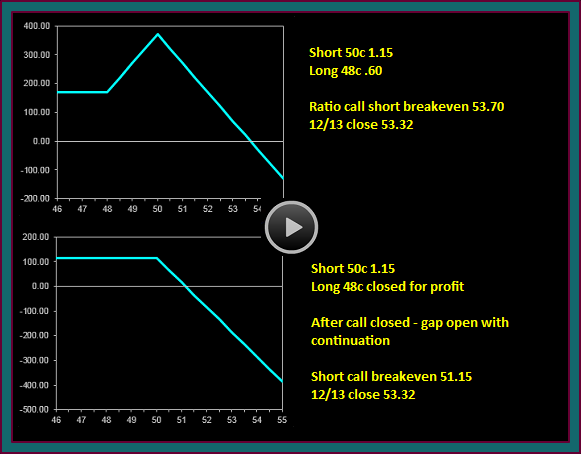

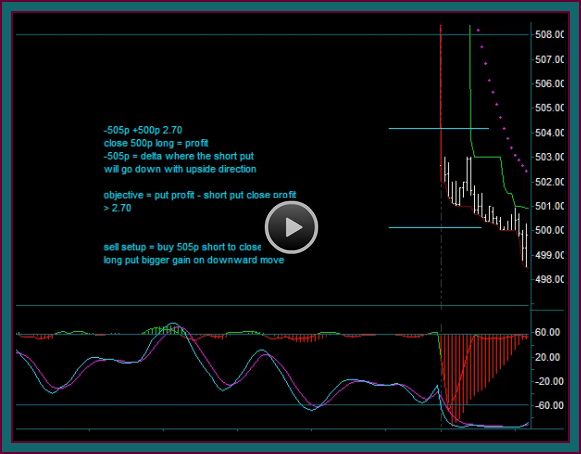

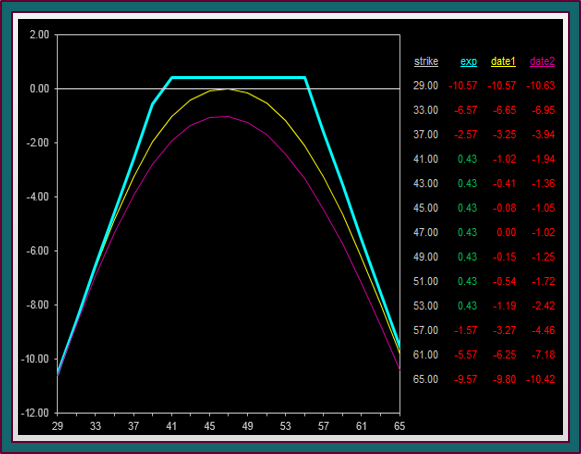

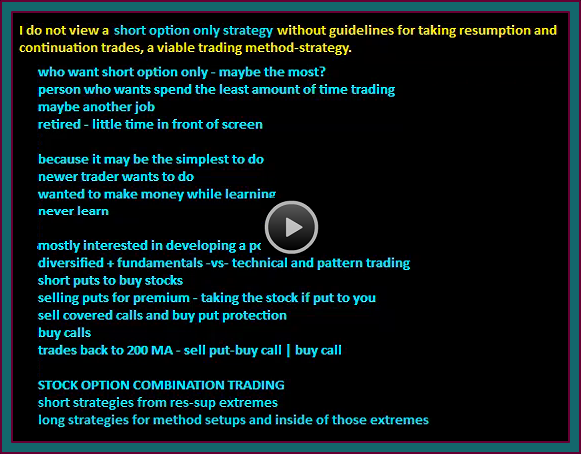

This video continues to discuss the risks from short option selling only, why I can’t view this as a viable trading method. Yes, we use short options strategies all the time, but only because they are combined with directional price continuation trades for protecting them.