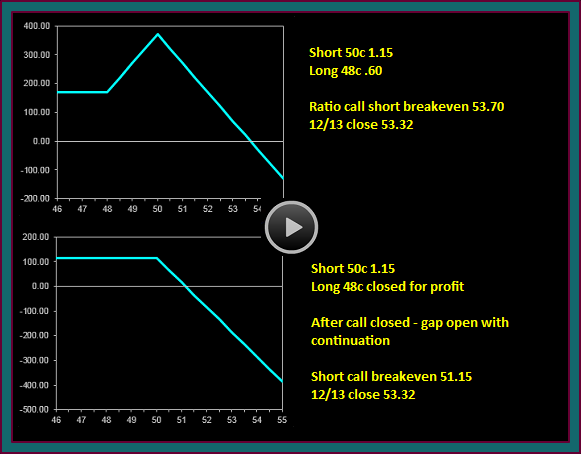

Facebook stock went into buy on our position trading chart at 46.35 on 11/27 and closed on 12/13 at 53.32 – but this directional price move also caused a short facebook 50 call to go deep in the money.

Additionally, a long 48 call, in a ratio call short with the 50 call and a breakeven of 53.70, had been closed for a profit – making the current breakeven point 51.15.

So, was the money facebook short call an uncovered losing trade, or were there any other stock and options protection trades done that actually made it part of a winning position?

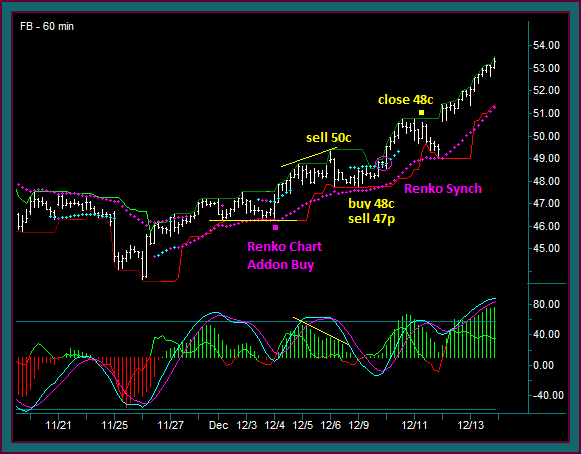

Facebook Price Movement 12/6 To 12/13

Let’s begin by taking a look at the chart from the renko trading charts and directional price movement video, which included an 11/27 and 12/4 Facebook stock buy.

And then we will review the 60 minute chart from 12/6 to 12/13, where we will go over some of the price moves and related options trades – along with the shorting of a call that ended up going deep in the money and past its breakeven point.

12/6 – 49.57 resistance – 49.39 pmd high test

- Sell 50 call 1.15 – 12/20 expiration

- No other strikes between 50 and 52.5

12/9 – 47.55 support – 47.74 47.71 double bottom test hold

- Timing chart buy for support confirmation

- Buy 48 call .60 – 12/13 expiration

- Sell 47 put .75 – 12/20 expiration

12/11 – closing low 49.01 and 49.38 close

- 50 short call .94 close

- 48 call long partial cover in call ratio short

- Closed for profit

- 50.77 double top – 50.50 lower high momentum extreme

- 2.50 close – .60 purchase

- Long stock completes cover

- Long stock addon keeps profit from being capped

12/12 – gap up open and continuation through 12/13 close

- 12/13 53.32 close

- Short 50 call not in ratio call short

- 3.54 close – 1.15 short

The short call has no options protection from the 48 long call in the ratio call short, which would have been lost 12/13 even if it hadn’t been already closed

- 12/13 53.32 close

- Short 50 call not in ratio call short

- 3.54 close – 1.15 short

- The short call has no options protection from the 48 long call in the ratio call short, which would have been lost 12/13 even if it hadn’t been already closed

- Were there any long options trade setup since 12/9 [when the 48 call was purchased] for the 12/20 expiration

- Or is this an uncovered short call with a big loss

Facebook Short Call Protection Trading

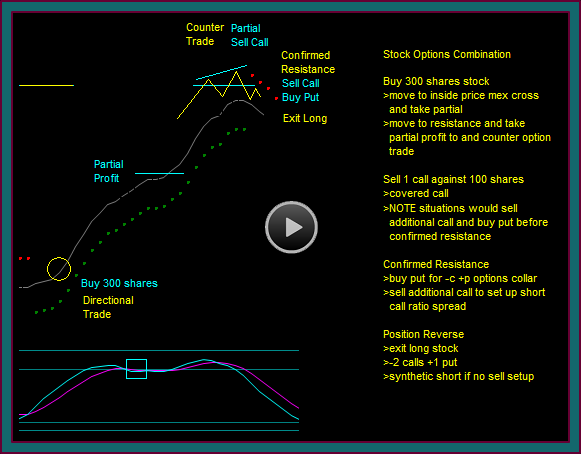

No, there was never a 12/20 expiration long options trade to protect the short 50 call. But no, this isn’t an uncovered short call with a big loss.

- The short call has been covered by long facebook stock

- There is long stock that has had its profit capped

- But the long stock short call combination is profitable

- 48 call profit 1.90 + 50 call short credit 1.15

- 50 + 1.90 + 1.15 = 53.05 –vs- 53.32 close

- Not the 3.54 – 1.15 = 2.39 loss

This is clearly an example of the benefits of our trading method stock and options combination strategies, with regards to selling options short and being able to protect them.

A stock protection trade profit may be capped at the short option breakeven point, but the trade combination is profitable. And depending on trade size and the potential for directional addon trades – there could be stock shares with uncapped profit potential.

Be the first to comment