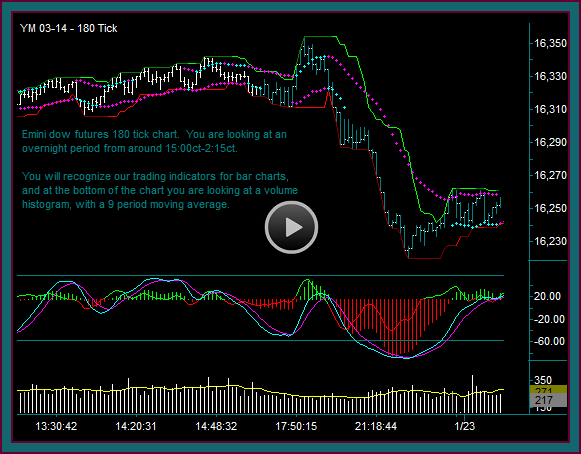

We are going to discuss emini dow day trading setups and trade management, by using renko chart and tick chart market replay. Beginning with the right side of the 2 charts, do you see the synced components for a base emini day trade setup?

- Yes, if we get a red midline brick followed by a green reversal brick

- With a fill of around 16105 and target1 at the channel high 16121 from the previous reverse

- But let me say that I don’t like trade setups like these – because I really don’t know where to price hold the trade

- So, I will take the trade if it occurs – watching the 16093 area, with the key being a quick breakout to the target

- This is why we care so much about mex flow build on a retrace – it does tend to lead to quick breakouts

- Long 16107 – entry on the 180 tick chart

Emini Dow Day Trade Setups And Management

(1) 16122 partial1 on the break

- I took the partial because of the open and didn’t want to worry about chop

- 16108 breakout area would shift to support

- 16148 next target

(2) 16129 partial2 on momentum extreme

- 16121 area shifts to support

- 8:31:07 – didn’t do an add because of momentum

(3) Sync chart setup

- 180t ttm –vs- mex flow

- Short 16116 on 16121 break

- Watch 16086

- Clear price initial risk using the lower high into the trade

- 16091 partial1 – 16083 partial2 – 16102 flat

(4) 9:00 buy – is there a momentum extreme?

(5) V reverse up after exit

- No trade setup to go long again – period ends with 180 tick pmd high

Question: With price testing the 16121 area that we have been using as an across the chart price AND doing so as a pmd high – what are your scenarios for the next emini day trade?

Be the first to comment