Options Trading Strategy For Locking In Current Profits

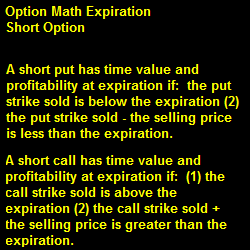

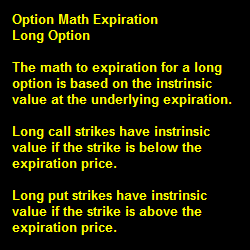

Risk reward evaluation and options trading math can be used for locking option trade profits, where you are protecting your existing profits and giveback, while allowing for increased trade potential.