In this renko chart day trading system video, we are going to setup our charts and then discuss some of the system trades and rules that occurred during the period.

You are looking at 2 emini dow futures renko charts – the right chart is a renko 5 brick chart and the left chart is a renko 3 brick chart.

Note that there are trade setups that will be taken from the renko 3 brick chart, but it’s the renko 5 brick that is the primary trading system chart for the rules for trade management and setup brick counting – this will all be discussed further, when we review the renko trading system trades.

Trading System Chart Indicators

I am going to put the system indicators on the 5 brick renko chart – these are the following:

- ttEnvelopeR

- ttExtreme

- ttVtyBand

The only indicator parameter that needs to be assigned specifically for the brick size is the price envelope – use .06 for the lower and upper band on the 5 brick chart.

For the 3 brick renko chart, we will use these indicators:

- ttEnvelopeR

- ttMExR

Again, we need to set the lower and upper band parameter for the price envelope – use .035 for the 3 brick chart.

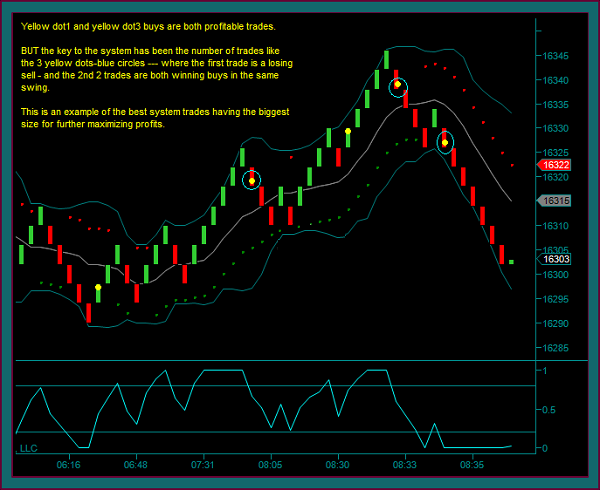

Renko Trading System Trades

The renko day trading system has 2 trade setups – they are referred to as:

- Renko midline reject

- Band extreme reverse

I am going to start from the high on the renko 5 brick chart – this is the same high point that you see on the renko 3 brick chart:

Renko Midline Reject Setup

At this time the system is long and we get a renko midline reject trade setup and reverse from long to short – this is the setup for this trade:

- Price envelope reverse from green dots to red dots

- Midline reject brick – this is the green brick

- Extreme indicator hook back below the lower extreme line

- Sell the midline reject reverse brick – this is the red brick

An important feature of the trading system is addon trades. They may come from either the 5 brick or 3 brick chart – the rule is that addon1 must occur within 3 bricks of the price envelope reverse brick, and addon2 must occur within 3 bricks of addon1.

There is no addon setup on the 5 brick, so let’s look at the 3 brick for a setup that occurs within 3 bricks of the initial sell:

- The time for the price envelope reverse brick is 9:20:12

- The time for the 3 brick after this is 9:31:54

- There is a 3 brick midline reject sell setup at 9:23:20 – this becomes addon1

- There is a 3 brick midline reject sell setup at 9:28:05

The trading system is based on 3 contract trades [it can be traded with 2 bricks] and uses partial profits:

- Initial trade partial1 = 4 bricks – partial2 = 3 bricks

- Addon1 partial1 = 4 bricks – partial2 = 3 bricks

- Addon2 partial1 = 3 bricks – partial2 = 3 bricks – exit if 3 more bricks of profit

Band Extreme Reverse Setup

All band extreme reverse setups come from the 5 brick chart – the trade setup is as follows:

- 5+ consecutive bricks from the last system trade

- Volatility band reject

- Extreme indicator break above the lower extreme line for a buy and below the upper extreme line for a sell

- Trade the counter brick

Count the bricks from the last system trade, which was addon2. You can see that we have 5 consecutive red bricks followed by a green brick – by the green brick.

The trade partial profits are the same for the band extreme reverse as they are for the renko midline reject, so we are looking for 4 bricks after the buy brick for partial1.

We get that partial profit and then a 5th consecutive green brick followed by the red counter brick. This will be a band reverse sell, unless there was a 3 brick addon setup after the price envelope reverse brick – there wasn’t, so short at the red brick.

This ends this video for the renko day trading system indicators and the entry rules for the 2 system trade types, including addon trades, along with the profit rules.

Go to the renko chart day trading system page for the system rules manual, including the stop loss for the system trades. Additionally, this page has numerous videos that review system trades and trading rules.

Be the first to comment