This trading video discusses options spread legging, which is the entry or exit of one of the option legs that make up the spread.

There are 2 primary reasons for legging into or out of an options spread: (1) the potential to buy the spread at a better price and sometimes even at a credit (2) the potential for exiting at a bigger profit and sometimes more than the original width of the spread.

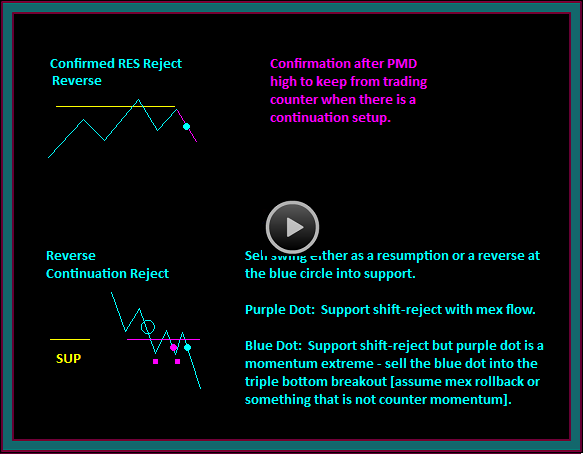

However, for legging to be an effective strategy for improving entry prices and/or the profit of the option spread, it is important to use trading method timing setups:

- If buying a call spread – buy the call on the setup entry and sell the call to complete the spread at a profit target or a reject of resistance

- If exiting a call spread – sell the long call with a sell setup and buy back the short at a profit target or a reject of support

Additionally discussed in this options spread legging video:

- Timing a long call spread exit after a gap down exit

- Buying a long call spread and where the legs were entered

- Problem with exit timing – example of a long debit spread that could have been exited for 3.00 was legged out of by a trader for 1.80

Be the first to comment