In this video we are going to focus on short options trade entry and the best setup timing for reducing risk, along with enabling a price continuation moves that will allow for trading into better option spread pricing.

Using trade entry timing setups are important for our stock option trading strategies, because they increase the odds that the trade will have some movement in the intended direction.

Some of the different aspects of the short option timing trading strategies that will be discussed are:

- When is a support or resistance price hold confirmed

- Short options entry and trading into a spread

- Protecting a short option if the current move resumes immediately after putting the short option trade on

- Comparing different option spreads – especially trading into option debit spreads at a credit and ratio credit spreads

- Comparing a short call to a covered call – after we have a swing resumption setup and need to protect the short option

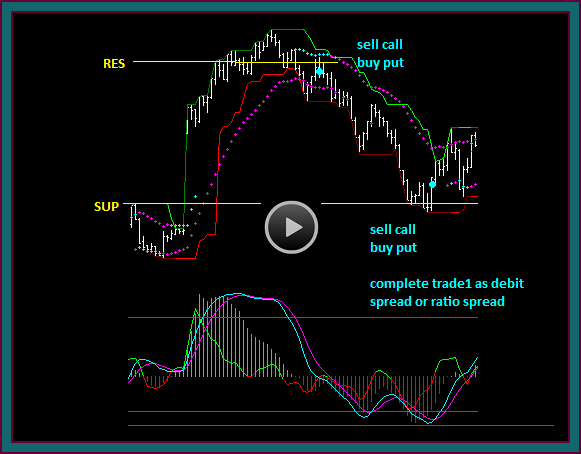

You are looking at a trading chart and key to our trading method and trade setups involves chart reading for price failure – price can fail in two ways:

- It can fail when it confirms resistance or support, meaning that price failed being able to continue through these points.

- It also can fail on a continuation set up pattern, where a given price is tested followed by a retrace – and then you get a second break and failure of that price.

The chart you are looking at involves confirmed resistance and support timing at the blue dots. You can see that the two yellow lines have been marked as resistance and support prices.

It should be clear where support came from, which was the high before there was a retrace and then a gap up above that price – if you would trade back to the price it would be viewed as chart support.

The resistance price actually came from the left of this chart. It was originally a swing high followed by a sell-off – so now if we traded back to that price it would be viewed as chart resistance.

Short Options Entry Timing Video Outline

Trading method chart reading for entry timing:

- Where resistance and support come from

- Inside focus line from opening low

- Reject-MEx extreme cross short options entry timing

Before we go further and talk about the short option strategies, let’s discuss the inherent risk from short options.

- Especially because risk is unknown

- Call –vs- puts

- Takeover risk

- Gap risk

- Avoiding known news

- Why entry timing is so important

- Trading with a protection scenario

Scenario Chart1

- Short option traded into debit spread

- Protection trade if swing resumption after selling option

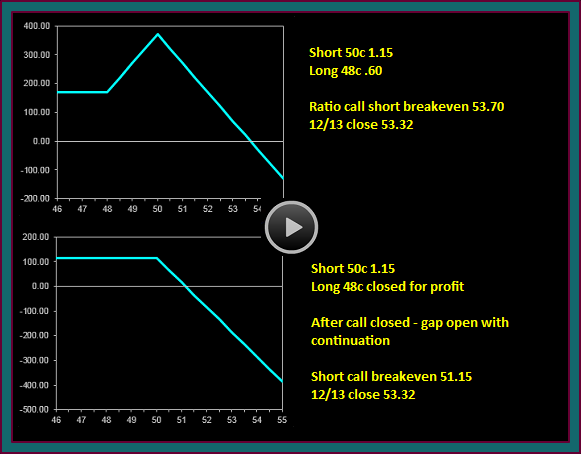

Profit graph1

- Debit spread entered at same time

- Debit spread traded [legged] into

Profit graph2

- Short call

- Short call with long stock – covered short call on swing resumption

Scenario Chart2

- Sell option-buy option entry –vs- short option only

- Completed spread

- Call and put debit spread

- Call spread is debit at a credit

- Call and put ratio short spread

- Emphasize that the short option in a ratio spread is not completely covered

Profit graph3

- Call debit spread at a credit

- Ratio call spread

- How risk is reduced by wider breakeven range

- Wider breakeven range better protected because of the b/e distance and more room to do a covering stock trade

Be the first to comment