Our renko chart trading will use a new group of trading indicators that are coded for the TradeStation and NinjaTrading charting programs. This video will discuss the renko indicators inputs and parameters, along with the related chart setup.

But before talking about the renko indicators and chart setup, I want to give some of my general thoughts at this point about renko trading charts and how they fit our trading method strategies:

- The primary strengths with renko trading charts come from the way they can show directional moves, while removing a lot of noise from the charts.

- This can be very helpful with staying with direction and avoiding consolidation trading

- I suppose this is more of a neutral than a strength or weakness, but it does take some use to when trading the renko charts – I am referring to how few bricks you may get, because so many of the price bars are eliminated

- However, this is also what can eliminate a lot of the consolidation trading that is best to avoid

- And this allows for monitoring a lot of different charts for setups

- The primary weakness with renko trading charts come from the way they show price in the form of the brick size –vs- showing all chart prices

- We are directional traders, but we are significant price and price action traders – we must know where chart resistance and support is located to trade our method

- The renko charts, at least on TradeStation do not show gaps – they show connected bricks as if the gap was an actual trading move

- I would also say that this leads to the renko charts being best for underlying trading or synthetic options trading – I do not see using them for our counter options trades that must be able to see confirmed support and resistance patterns

- The renko charts are also best for real time trading –vs- past chart study – the reason for this comes from updating the charts and getting some different bricks than may have occurred real time

- Different charting programs may also have some difference – although we have always confronted that with using tick charts and know that each trader must trade their own charts

- I don’t think this has a large effect of trading profits

- But all of this said, I do think that the renko charts provide a lot trade entry chart reading benefits – and in many cases are easier to trade than time or tick charts

TradeStation Renko Trading Indicators

Now let’s look at the renko chart trading indicators and setting up the charts.

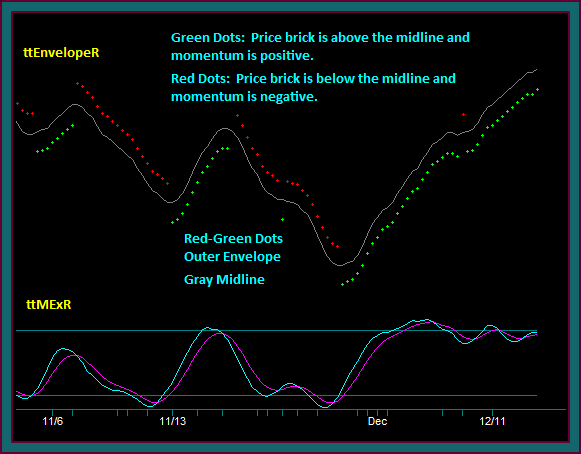

There are 2 renko indicators that will be called ttEnvelopeR and ttMExR – the R simply refers to these indicators being for the renko charts.

Let’s begin by talking about the renko indicators for TradeStation. The ttMEx indicator is the same as we have been using on our other trading charts, but I have made some parameter changes that I want to mention.

ttMExR Indicator

Although ttMEx has user inputs that can be changed, I am sending this out as a separate indicator with the renko default setting.

I think it will be easier to simply apply this indicator to the renko charts, as well as being less likely that the different parameters get used on the time or tick charts.

ttMExR Parameter Defaults:

- Length = 8

- Smooth = 8

- xL = 60

- xH = 60

I made the ttMExR parameters faster, because I could see that it gave better synch with the renko bricks and the ttEnvelopeR indicator.

This is likely a function of getting fewer of the renko bricks that we would tick bars or time bars. I made the ttM indicator parameters, which are used as a dot shift condition, faster also.

ttEnvelopeR Indicator

The ttEnvelopeR indicator is new for the renko charts and will be used instead of ttDC. This indicator is a price envelope that shows a moving average line and dots for the outer envelope that are green or red, depending on 2 conditions: (1) whether price is above or below the moving average (2) whether momentum is position or negative.

Note: The momentum condition uses ttM, but with different parameters than we normally use that will be mentioned in a moment.

TS ttEnvelopeR Parameter Defaults

- PriceH PriceL Price = close

- These are parameters that use the last price for doing the calculation – I will not be changing this indicator input

- Length = 9

- This is used to calculate the moving average or what I have been calling the midline

- This is the dot shift condition1

- The renko brick must be below the midline to get the red dots on top or above the midline to get the green dots on the bottom

- LengthM1 = 9 LengthM2 = 12

- These are the ttMR momentum inputs

- Momentum is the dot shift condition2

- Momentum must be negative to get the red dots on top or positive to get the green dots on the bottom

- At the same time as the midline dot shift condition1

- PctAbove = 1 PctBelow = 1

- These are the parameters that are added or subtracted from the midline to set the dots location

- This is a parameter that will frequently change for different underlyings and renko brick setting

- This is a function of the amount being a percentage

- Where 1% of a $45 stock is .45 – and will synch with the brick extremes

- 1% of a $500 stock is $5 – and would be a lot higher or lower than we want the dots to be located

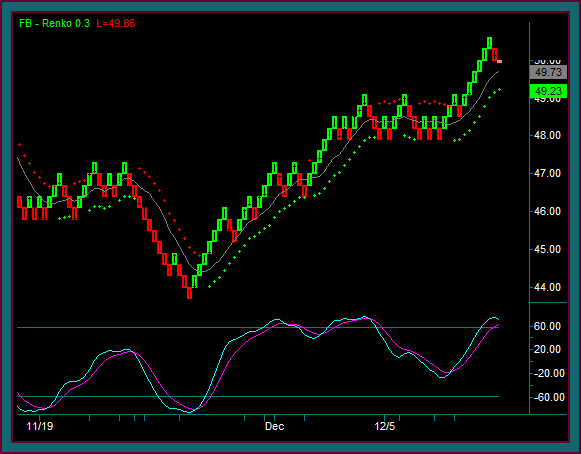

Renko Trading Indicators On TradeStation Chart

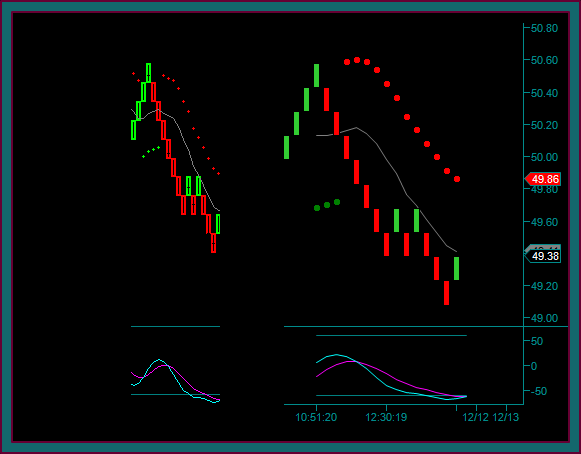

You are looking at my TradeStation renko trading chart with the ttEnvelopeR and ttMExR trading indicators. You can see that this is a facebook renko chart using a .3 brick size, with the last price 49.86.

Looking at the chart we can see that the indicator conditions make the chart in buy, and although mex is extreme it hasn’t crossed or shown a price momentum divergence yet.

If you will look at the envelope dots, you can see that they are green on the bottom:

- The dots shifted from red to green when the brick was above the midline and momentum was positive – both of these conditions must exist to get the dot shift reverse.

NinjaTrader Renko Trading Indicators

Again, ttMExR is the same mex indicator you have been using, but with the different parameters for the renko charts.

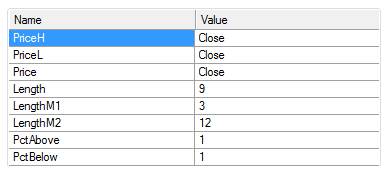

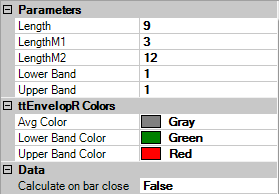

The NinjaTrader ttEnvelopeR renko indicators uses the same default parameters as TradeStation – looking at the indicator input screen:

- You can see that PriceH PriceL Price are not inputs, using the last price is built into the indicator code

- Length 9 – this is the length for the envelope midline

- LengthM1 LengthM2 – this is the parameters for the renko momentum condition

- Lower Band Upper Band – this is the percentage added or subtracted from the midline to get the outer envelopes

- This is the same as the PctAbove PctBelow indicator inputs in TradeStation

Look at the last input line you can see on the screen print it says – calculate on bar close:

- NOTE: this will be True when the indicator is applied to the chart

- You want to change this to False – so you can get an indicator plot on the last brick or price bar before it is complete

- Using the setting of True will only plot on complete bricks or bars

Renko Trading Indicators On NinjaTrader Chart

You are looking at a NinjaTrader renko trading chart with the ttEnvelopeR and ttMExR trading indicators.

I am sorry that I don’t have a better chart, but the only data source I have for NinjaTrader is interactive brokers, and that doesn’t fill in any of the historical data.

But you can see how this compares to the TradeStation chart segment on the left – and that the renko indicators essentially give the same readings. I do know that the indicator math is the same for both programs.

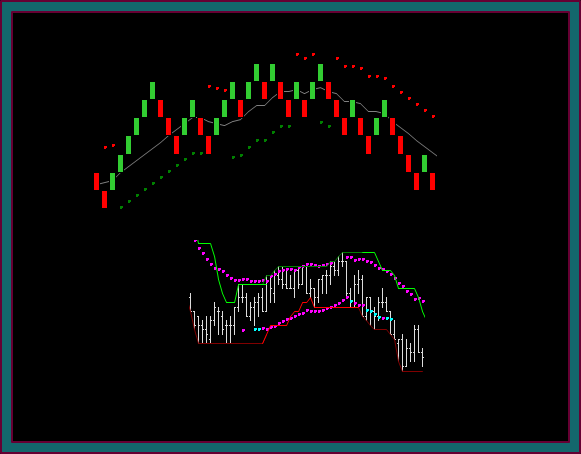

Here is one more TradeStation and NinjaTrader indicator comparison – I used a 5 minute chart because I could get some more historical data for NT. Again, you can see that both charts and indicator readings are essentially the same.

So, there you go with a renko trading indicator discussion. Get your charts setup and let me know if there are any questions.

And I will certainly let you know if I change any of the base parameters, along with doing further discussions about the selection of the outer envelope parameter and the renko brick size.

Be the first to comment