In this video, I am going to discuss our renko trading strategies base trade setup, along with what it means to be a base setup.

The renko base trade setup distinction is important, because this is the setup that has been determined to provide our most consistent and high odds trades, along with giving us a ‘model’ to compare other trading decisions to.

Additionally, the base trade setups are the clearest setups to see real time while trading, because the setup components have been determined and are either in place at the time of the trade or not. This in contrast to other possible trades that would be more discretionary.

I like to think of a base setup as the trade I will always take. This of course assume that there is room to the profit target before a price resistance or support point is going to be hit.

Go to the website section for renko chart trading, and you will find other videos discussing the base renko trade setups and components.

Renko Base Trade Setup

The following 4 setup components must all occur or exist at the time of the trade, for the renko trade setup to be referred to as a base.

- Price envelope reverse

- Reject-reverse renko brick pattern

- Midline reject

- Mex flow

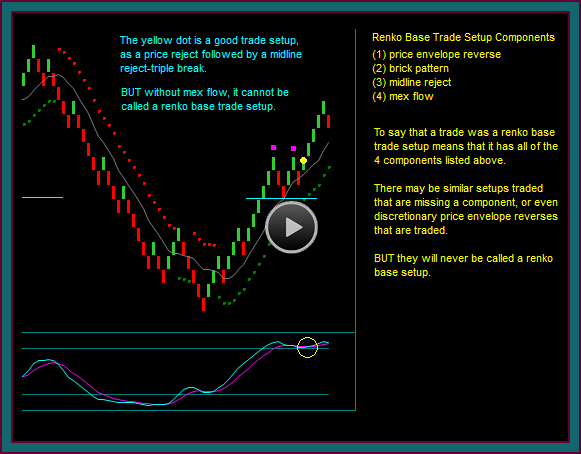

There may be similar renko trade setups that are missing a component, or even discretionary price envelope reverses that are traded – these may be good trades, but they cannot be called base setups.

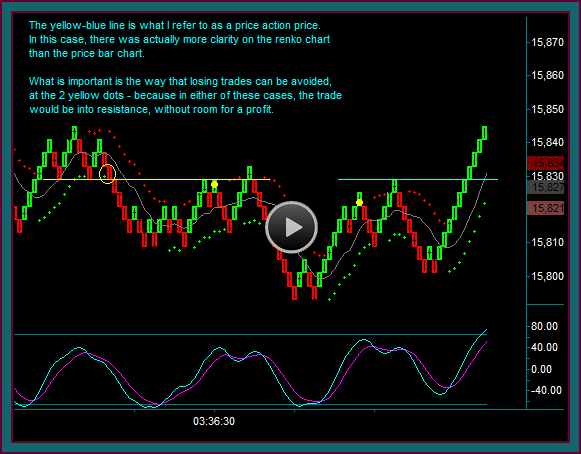

For instance, look at the yellow dot buy on the chart. This is a very good renko trade setup that has a left-right price reject and triple break entry that I traded as an addon – but it is not a base setup, because it only has 3 of the 4 components.

What is the missing trade setup component?

The missing component is not the price envelope reverse. It is fine that the trade doesn’t immediately follow the red-green price envelope dot shift – it is still with the price envelope, which will be the case for all continuation trades.

But as you can see by the yellow circle on mex flow, there is a mex rollback instead of the green-red-green brick pattern with mex flow still going in the direction of the trade.

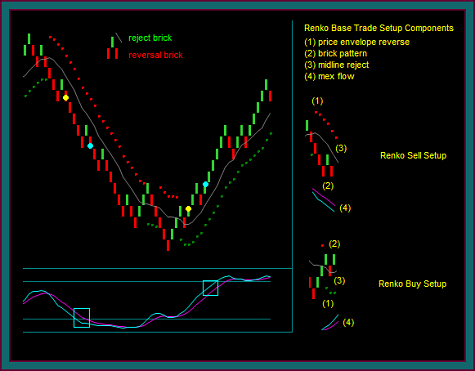

Renko Trade Setup Base Components

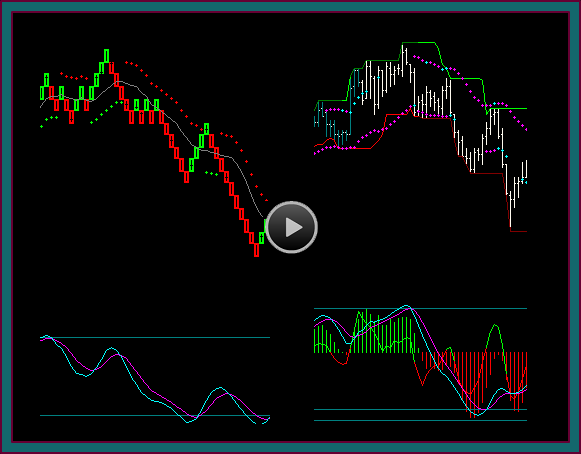

You are now looking at the renko trading chart with the base trade setup components labeled, along with the trades marked on the chart:

- Price envelope reverse – this is the dot shift from green to red or red to green, and denotes the direction of the trade, if there is a setup

- NOTE: you might hold a trade for a price support or resistance point against a price envelope reverse, but not take a trade against the price envelope direction

- Reject-reverse renko brick pattern – the renko base setup has a 3 brick pattern, like you can see highlighted at the top of the chart

- A sell is a red-green-red brick pattern and a buy is green-red-green

- Think of the ‘inside’ brick as the reject brick and the 3rd brick as the reversal brick

- NOTE: there will be instances where the entry may be 4 bricks, like red-green-green-red for a sell – and they will be good trade setup entries

- We just won’t call them base – again, we only want to call a trade setup base, when it has the exact component configuration

- Midline reject – the midline is the gray line in the center of the envelope, and the reject is the inside brick-brick3 combination

- NOTE: the reject may miss the midline a bit like yellow dot1, or break it a bit like yellow dot2 – these midline test reject do not need to be ‘perfect’ hits

- Mex flow – mex flow is not simply the direction of the mex indicator, it is the direction after the price envelope reverse and at the time of the reject brick

- NOTE: especially look at the blue dots on the chart and blue boxes on mex – these are both continuation trades, and you can see how there is still mex flow in the direction of the trade when the midline rejects

- This is in contrast to that first continuation trade that I showed you that was a mex rollback instead of mex flow

- NOTE: especially look at the blue dots on the chart and blue boxes on mex – these are both continuation trades, and you can see how there is still mex flow in the direction of the trade when the midline rejects

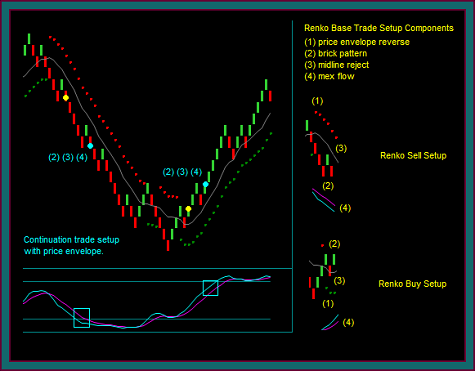

Renko Continuation Trade Setups

On this chart, I labeled the renko base trade setups that are continuation trades – these are the blue dots, as compared to the yellow dots that are the initial price envelope reverse renko trade setups.

- Both of the blue dot trades setups have the base setup brick pattern, midline reject, and mex flow – but you are reading the price envelope direction –vs- the price envelope reverse

- NOTE: also look at the price envelope and midline slope at the time of a continuation trade – it is an indication that there is still good price momentum for taking the trade

This ends this renko trade setup and base trade setup reference video.

I suggest learning the renko base setup components and trading them when they occur. Be sure that you can see them and trade them real time, which should lead to profitable trading.

And when you are comfortable with the base trade setups, consider trading variations of them.

Be the first to comment