In this Yelp position trading video, I am going to do an update for the stock and options trades done from 3-18 through 3-28.

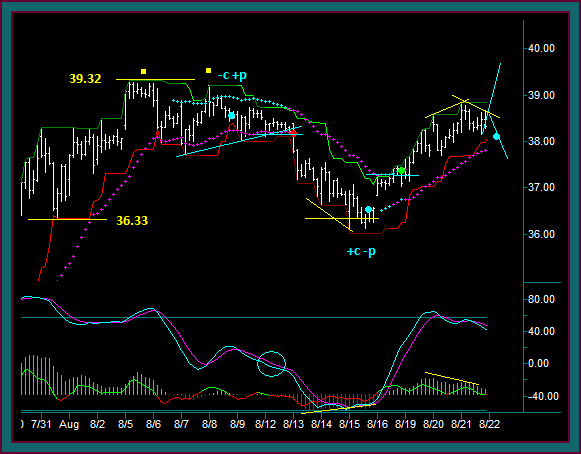

Our previous yelp stock and option position video ended with the following closing position, as marked on the chart below:

- Red dot1 – short yelp 96.65

- Yellow square – sell 85p 1.45 3-21 expiration

- Red dot2 – short yelp 90.85 addon

- Sell 95c 1.40 3-21 expiration

Yelp Stock And Option Trading 3-18 To 3-28

(A) 3-18-2014

- Buy yelp 89.30 – reverse out of all red dot1 and red dot2 shorts

(B) 3-19-2014 – 3-20-2014

- Red dot3 – short yelp 88.28

- Reverse out of 89.30 buy – have 1 unit partial at 90.74, but net loss on trade

- Note that the red dot2 addon had multiple partials and essentially a breakeven exit – making that trade a net winner

- Sell 90c 2.47 3-28 expiration

- I sold this call with the short and the premium did give a breakeven above the recent high – I would have liked a higher strike but didn’t like the credit

- Reverse out of 89.30 buy – have 1 unit partial at 90.74, but net loss on trade

- Buy 85 put 1.90 3-28 expiration

- Sync renko base

- 85p calendar spread protection

- Short 3-21 put

- No ratio spread but it doesn’t matter – this is expiration and I would have stock put to me if I didn’t close a short put that was in the put

- By doing the long put with the yelp short, I can also setup a ratio put short

- Short 3-21 put

(C) (D) 3/21/2014

- 3-21 Blue line-yellow square reject – close 3-21 85p 1.95

- 3-24 sync with renko yellow circle1 into triple top breakout

- Could sell 4-4 expiration 80 put 1.50 – but didn’t like doing this back into the blue line double top shift line resistance

- I did use the pmd to close the long 85p 2.70, since I wasn’t doing the ratio short here

(E) 3/24/2014

- If E had been followed by a higher low and the look of a resistance triple top breakout – then I would have sold a put

- Sell 90c 1.70 4-4 expiration – 91.70 gets me right above the recent highs and I would be looking to go long for protection of a failure of the blue resistance line

- I was also going to do a short addon off the double top into the pmd low – but looking at renko yellow circle2 at the time and didn’t do the trade

- Renko yellow dot [synced with tick chart blue square reject] – short yelp addon 80.24

(F) 3-25-2014

- Pmd low addon partial 3-25 77.74

- Renko yellow circle3 – exit addon 78.88

- Sell 75p 2.20 4-4 expiration

- Continued to trail remainder of red dot short

- Didn’t buy a call for synthetic protection – because an 82c cost 2.10 and resistance was 82.48

- And with resistance here, I didn’t want to give up short call credits for a ratio spread

- Similar to what I said about E and if there was a higher low and a resistance-triple top breakout setup – that is what I was looking for to buy calls

(G) 3-26-2014

- Sell 83 call 1.95 4-4 expiration

- Short yelp addon 78.96

- Discuss position chart yellow square – counter momentum trade

(H) 3/27/2014

- Sell 74 put 2.10 4-4 expiration – buy 80c 2.75 4-4 expiration

- Synthetic protection for shorts that includes addon – note that if we go back to resistance now, we would be doing so at triple top breakout potential

- Held trailing addon short at renko yellow circle4 reverse

- Best partial = 74.60 – and have the synthetic protection

- Long 1 unit 80c 2.75 short 2 units 83c 1.95 = ratio call short 1.15 credit

- Again, because of the pmd low and resistance triple top breakout potential

- If we got back to resistance and it rejected – I would be inclined to close the long call for a profit and keep the short

Be the first to comment