Options spread adjustment trades can lead to a bigger profit than the maximum potential of the spread. But trying to make an adjustment, to an in the money options credit spread, on a large gap open is a low risk reward trade – and likely will lead to a bigger loss, instead of an increased profit.

There are a number of problems that increase the risk for adjusting in the money options spreads, especially after a big gap open, which include:

- Implied options volatility will have a large increase that raises the price of the options

- In the money options tend to have larger bid-ask spreads and lower liquidity because they are more expensive

- The options prices will change faster due to the increased volatility from the gap

If you get the direction of the next move after the gap wrong, not only will you have closed the option you should have held, the option you did hold will go further against you very quickly.

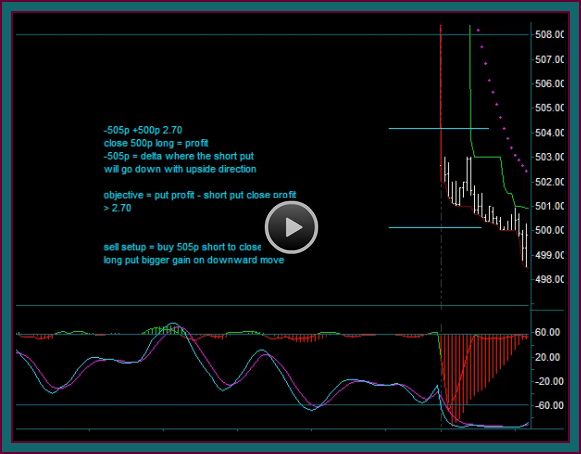

For instance, after a gap down open your chart read is that price is going up to try and fill the gap – however, it actually trades lower with the gap. But you closed the long put in a put credit spread, with the intentions of closing the short put for less money as price goes up into the gap.

Instead the short put increased in price, which was magnified by the continuation down making the bid-ask spread even wider.

Options Credit Spread Risk Reward Video

Do remember that if you made no adjustment to the put credit spread, it would not have mattered how low price went. Your maximum loss would remain the width of the spread, less the credit you received.

A call and put credit spread combination has been established, and there is a 17 point gap down that takes the put leg into the money:

- What is the risk on the put credit spread

- What is the risk on the combination spread

Should any adjustments be made through options trading strategies adjustments and legging out of the spread – sell the long put on a buy or buy the short put on a long?

- My answer to this question is a resounding NO

- The video discusses why the combination should be left alone

- Logistics for legging and using spread strikes are not met

Also discussed in this options spreads adjustment trading video:

- Trades done and the strikes used

- Good method trade setups that would be done if underlying trading but not done for option trading

- Setting up more spreads

The video ends discussing an option synthetic sell:

- -515c that has been held from a previous trade

- +495p which is a re-entry because there was not enough movement on a previous trade to spread it off – so it was a profit and eventual exit

Be the first to comment