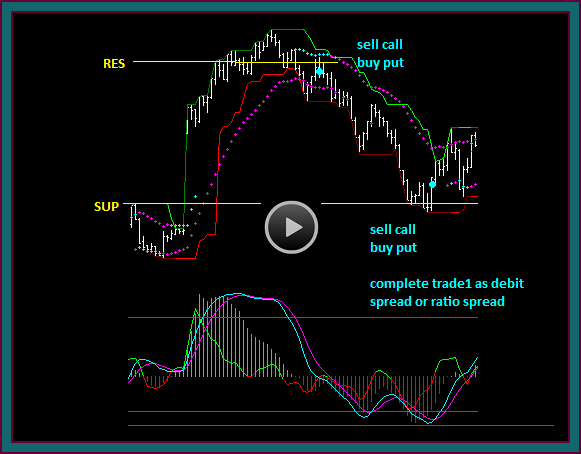

This video discusses options timing setups for the trading [legging] into and out of option spreads – specifically what I did to trade out of a long call spread that had been held overnight, but then followed by a gap down open.

When you leg into or out of an option spread, you do your trade 1 strike at at time instead of as a spread. Timing this ‘properly’ can give a number of trading profit benefits, so legging can be a valuable trading tactic – you will see in the video how more money was made even with the gap, than if the spread had been exited at the previous close.

We will be focusing more on options spreads legging in coming videos – including trading into option credit spreads that can’t lose money.

Options Legging Scenario

This is a simple legged options spread scenario, with a legged exit – when more money was made that the maximum at expiration. I will do a separate video on this, to go through it and explain it.

If you want to buy an option spread, for instance buy a 530 call and sell a 535 call, when apple is 525.00 – you could buy the 530c at the offer = 2.60 and sell the 535c at the bid = 1.25, and have a long call spread for 1.35.

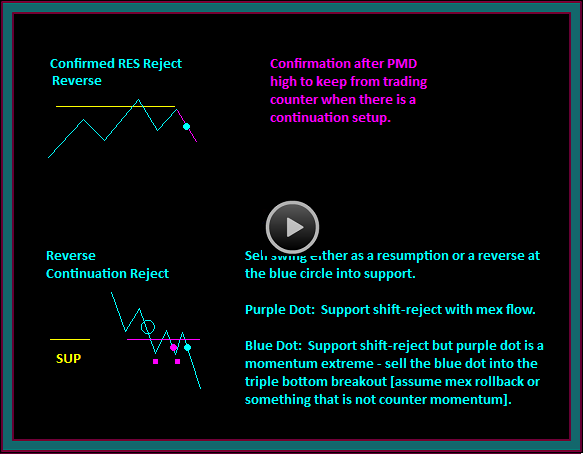

If expiration is at 531.60 you break even – and if it is at 535.00 or higher, you will make your maximum profit of 3.65. But that is expiration, if apple goes to 535.00 2 days before expiration, the spread may be around 4.00 [2.65 profit] – and then consider you get a ‘base’ sell setup.

Each of the option strikes in the spread is referred to as a leg – so legging is entering your spread one strike at a time instead of together. By timing this with a buy setup, you can accomplish 2 things:

- You won’t give up the bid-ask spread on both legs, which if the spread is .15 = .30

- You can improve the cost of your spread by buying the long call with the setup and then selling the short call at a profit target – if the short strike goes up .60 on the move, your spread will be .75 instead of 1.35.

Now, what about the sell setup when your spread is only 3.00 and is completely in the money – what if you sell the long call for a profit, and then buy back the short call on a move down?

- Sell the long call at 9.00 = +6.40

- Buy the short call at 5.00 -2.00 = -3.00

- Your profit is +3.40 compared to the +2.65 at the time of the sell setup, or the 3.65 maximum

And depending on how far the sell goes, you may even be comfortable holding the short:

- If your short expires worthless you make +1.25 – the amount it was sold for

- You already made +6.40 on the long call = +7.65

- And if you improved you spread price by legging you made another .75 = +8.40

- +8.40 profit compared to +3.65 maximum on an ‘unlegged’ spread that expires in the money

Be the first to comment