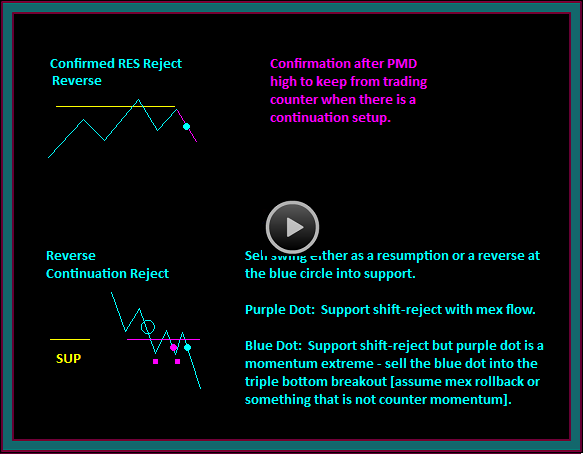

The price reject continuation trading pattern setups are different than the confirmed price resistance or support patterns from the standpoint that (1) the price reject setup is a swing continuation pattern (2) the confirmed reject of resistance or support is a swing reverse trading pattern.

The difference between a price reject reverse and a price reject continuation trading pattern is significant to our trading method strategies – remember that we focus on price continuation first and price reverse second.

You will remember some of the primary reasons for this distinction from this chart discussed on a previous video:

- When we take a trade based on a reverse pattern, we typically are in a trade going in the option direction – meaning that we would have to give up the directional trade to take a counter trade.

- That is also why we trade stock and options combination strategies – where we would begin the price reverse setup with an options trade against our open directional trade

- Swing reverse setups may actually be continuation setups

- For instance, think of the pmd high at resistance – this may actually turn into a pmd failure, which would be a resistance price failure continuation trade setup

- This is why we are so concerned with the confirmed reject aspect of the setup

- When we take a trade based on a continuation pattern, we are either adding on to the trade direction we are already trading, or we are looking to enter the reverse direction after going flat.

Now compare the confirmed resistance reject reverse to the reverse continuation reject:

- The confirmed reject is an additional leg to the pattern showing that price has failed trying to go through resistance – again keeping a directional reverse sell from being taken, when there is actually a price failure continuation setup

- The continuation reject has the following characteristics:

- Price has already reversed into sell and is testing support

- Support breaks and rejects [shifts] as resistance

- Note: I tend to call a pattern like the purple dot a ‘break and hold’ or a shift reject

- Selling the purple dot would be the first continuation setup after the blue circle price reverse

- Don’t take this trade if momentum has already gone to an extreme – we would read that as being traded into a pmd low

- Remember that this pattern is being chart read as a continuation setup – trading into a pmd low often precedes a reverse and is thus not viewed as continuation

- In the case that the purple dot is a counter momentum trade

- Wait for a pattern similar to the blue dot

- You can see the double reject of the purple line into what would be a triple break of the 2 purple squares

- The time the pattern takes to develop should ‘take-away’ the momentum extreme

- Making the blue dot a price reject continuation setup

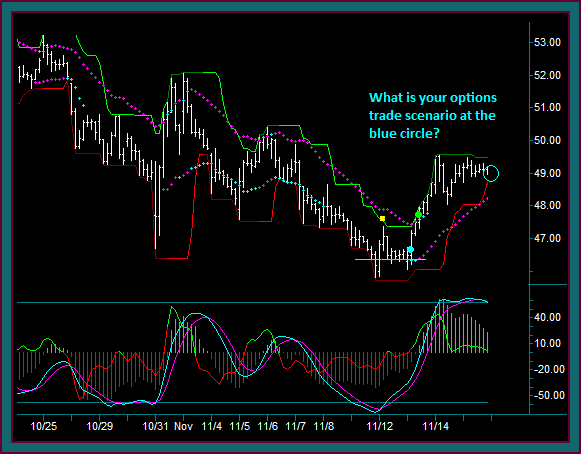

This trading chart shows the left side support price at the yellow line and the break below this price without a sell setup:

- Sell the red dot as a price shift-reject continuation pattern

- NOTE: the actual timing stayed away from the consecutive bars and mex cross up – there was a clear retrace to the yellow line and the mex rollback down

- This is also a synthetic options setup – buy a put sell a call

- Look at the prices for a 48.00 put and a 49.5 call

- Since the synthetic option trades are basically stock equivalent trades – you want a delta that will allow for a profit on a move to the next target

- With support at 47.37 and the sell at 48.45 – a 70 delta would give you a profit of around .75

- The reason to do this in addition to a stock trade would be as a short options strategy for creating ratio short option spreads

- But still give the short call an ‘extra’ strike – because of the extra week of time

- NOTE: this trade can be made using the put buy from this week and the call sell from the next week

- This would allow the trade to be done at a credit

- And you would only keep the call short if the trade was profitable

- On a move to target support – you can look to turn the call into a ratio call short

- And you could look at put for the following week to create a ratio put short

- This will be a covered trade while the stock is short

- Buy 48 put 11/22 exp .55 – Sell 49.5 call 11/29 exp 1.00

- Put delta .40 – call delta .405

- IF 47.37

- Put thv = 1.15 – .60 profit

- Call thv = .65 – .35 profit

- .95 profit on .80 delta trade – largely a function of put delta increase and gamma impact as otm put goes into money during expiration week

- With support at 47.37 and the sell at 48.45 – a 70 delta would give you a profit of around .75

On the facebook trading video about short stock option position adjustments – we ended the video with this chart and the question:

- What is your options trade scenario at the blue circle?

- That circle actually synched with the area we just discussed on this video – with support at the yellow square

- I am going to end this video with another question from the previous chart:

- Is the blue dot a confirmed support reject trade setup – and what are the trades that would be done?

- We will combine both of these questions and related trades on the next facebook stocks and options trading strategies video

Be the first to comment