Although selling options for additional income is a popular trading strategy, short options selling only comes with additional trading risk. This is because the risk-reward profile is one of a small maximum gain, relative to an unknown and unlimited [theoretically] potential loss.

What do I mean by selling short options only? I am referring to shorting uncovered options without combining any stock or options spread strategies for risk protection.

Although our trading strategies do include shorting options for trading income, as well as for synthetic options trades – I do not view selling options only as a viable trading method. And I say this, even though our short options trades entry timing, leads to a high odds for profitability.

On the other hand, a directional trade has an unlimited [theoretically] potential gain, where the loss is known if it is a long option, and predetermined by the size of a stop if it is an underlying trade.

This video discusses why I don’t want a short option selling only method, but using it as a strategy that will include directional continuation trades. Further discussed are the following points:

- People who are most likely to do short option only trading

- Issues with protecting price continuation breakouts -vs- capped gains

- How short options fit for a portfolio development strategy

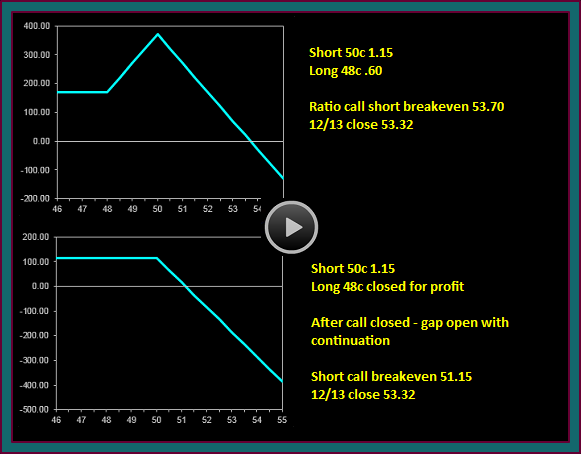

- Chart examples of how short options only would be ‘crushed’ – but could have been very profitable swings

- Overview of scenario work for a short option ‘base’ strategy

Using short options strategies are an important component of our trading method strategies. But again, remember that the options are done with an understanding of ways to protect them, before they go into the money and beyond their breakeven points.

Be the first to comment