The renko chart trading replay training videos, have shown the importance for focusing on trade preparation and the different trade setup components that need to be seen real time:

- Existing trade setup components that can see been seen as they have developed and should be watching for real time

- The additional setup components needed to complete the setup and enter a trade

- The trade initial risk and profit target when take a trade

Additionally in this video I also want to discuss some renko trade setup brick patterns used for entering trades:

- The 4 brick renko pattern as a base setup entry

- Renko brick patterns that include a triple break, especially after a double hold

Renko Chart Day Trading Training Video Outline

(1) Price envelope reverse only on brick1 – and I hadn’t started trading yet anyway. I also haven’t done a trade yet on this red-green-red brick continuation pattern, but am looking for a trade.

- What would now put you in a sell – you can see that you still have the following setup components

- Price envelope reverse

- Below midline

- Mex flow

- Risk and profit target if trade

- 16160 area initial risk

- 16132 renko target – 16131 real price

(2) With the red-green-red-green – concerned that looking at a higher low double bottom reverse

(3) Short 16147

- 4 renko brick entry pattern

- NOTE issues:

- Not our basic midline reject brick pattern

- Mex pinch –vs- clear flow

- Why trade

- Triple break setup with nothing in way to 16131 profit target

(4) Could partial – but like that brick pattern stall into the target

- 2 red bricks-2 green bricks are a midline reject triple break setup into the target

- These stalls into a target like this often are breakout setups

- Will take 16140 if not through

(5) 16120 partial

- Move hold to 16136 area – above 16132 retest as resistance

- 16108 next target

- NOTE: with mex extreme crossing – take p2 if no continuation

(6) 16119 partial2

- Price envelope reverse and 16132 re-test

- Rejects or flat – it’s a price action –vs- price hold at this point

- AND be sure to note setup components for reversing long

- Have everything besides midline reject brick-reversal brick combination

- So depending on the next brick[s] – very well may reversing out of the short

(7) Higher low – price envelope and midline break

- 16130 flat – no reverse

- Can see buy setup components

(8) Buy 16136

- Renko base 4 brick pattern entry

- Includes 16132 price failure break entry

- 16156 brick high into sell target1

- 16126 area initial risk

- Would give 16132 re-test room

(9) Ending video

- Do note that price did continue to partial target1

- Question: why wasn’t renko 16144 and the green brick-midline reject partial target1?

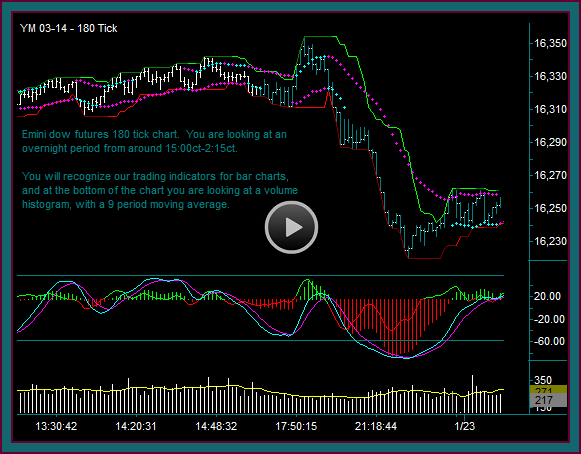

- Because the 180t clearly showed the actual price action and trade entry to be a failure of that price area

- AND that 16144 was not relevant as a real price

Be the first to comment