After our 2 previous stock and options position trading basics videos, I want to now take a look at my recent position trades on YELP and Facebook. This video will discuss the YELP trades done after their earnings release.

You will remember that the position basics videos started with stock trades and then counter options trades were taken on a stock buy that moved to resistance – and that is how the facebook trading position was started.

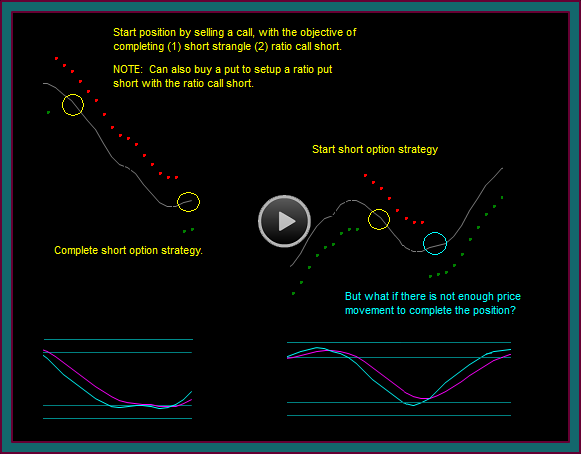

We still need to discuss starting with an options sell, and since the first YELP trades were option sells, it will be a good overview for beginning a stock and options position this way.

Yelp After Earnings Position Trades

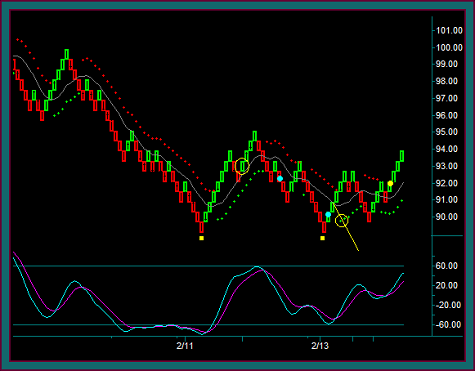

You have been looking at the position chart from after yelp earnings. I was flat all stock and option trades ahead of earnings and the first trades that I did were on 2-12.

NOTE: the position chart is RTH, and when we look at the renko chart it will be ETH

- 2 blue square double top – the left square was the high after the RTH open and earnings reaction

- You will see that this syncs with a renko sell

- Sell 2 97.5 calls 2-21 expiration 1.12 = 98.62 breakeven at the top yellow line

- I would look for a triple top break setup to start covering-protecting that trade

- If we would retrace to the bottom blue square inside the double top, I would look at the options prices for completing a ratio call short

- 2 blue square double bottom

- Sell 2 85 puts 2-21 expiration 1.20

- Breakeven = 85 – 1.20 – 1.12 call sell = 82.68 at the bottom yellow line

- NOTE: the 98.62 upside breakeven now increases by the 1.20 to 99.82

- Sell 2 85 puts 2-21 expiration 1.20

- These are the breakeven prices IF the ratio call spread wasn’t completed

- I didn’t do this and it was a function of option prices

- On 2-13 I couldn’t buy a 2-14 call that would expire the next day – and I would rather take a buy setup and use what the options would cost as stop money

- So, I have a short options strangle – and my immediate focus after selling the puts would be a triple bottom break stock short

- I don’t do too many of these, because there is usually a stock trade inside of the 2 option sells – but not in this case

- But there is nothing wrong with these – and I would be ok if the short options strategies were all a trader wanted to do

- IF they were willing to take the stock trades into breakouts that could continue and would cover the option shorts

- Green dot is a stock buy at 92.10

- You can see that the position chart is in buy and a ledge break setup, with a 94 target from the blue squares

Yelp Renko Position Timings Chart

Here is the renko chart – let’s identify that timing and setups for the trades that were just discussed. Remember that the renko chart is an ETH chart.

- Yellow circle 2-12 – is this a base renko buy with the position direction

- Yes, but the trade was at 3:26am at around 92.80 and 94.00 being read as resistance

- Since I was actually up, I would have done the trade if needed to protect a call short – but the calls hadn’t been sold yet

- NOTE: If this time of day for protection concerns you, the trade doesn’t need to be done to protect what would become a 98.62 breakeven

- I just like to take position trades, along with protecting before actually necessary

- Renko blue dot sell

- This is the timing for the call sell – and since the position was in buy there was no stock short done

- Renko blue dot after double bottom

- This is the timing for the put sell after the double bottom

- The position chart is ttm red now – and if there was a renko setup like the yellow line-yellow circle, the position chart would have reversed

- I would have done the short into the triple bottom breakout and the puts were just sold – I would not want to be flat if price started filling through that initial earnings reaction price bar

- Renko yellow dot

- I cannot call this a renko base setup because there is no mex flow – but mex is crossing back with the price envelop and midline reject

- This is the synch with the green dot on the position chart and the 92.10 buy

Yelp Stock And Options Position

- Short 97.5 calls 1.12

- Short 85 puts 1.20

- Long stock 92.10

I will plan to do a stock and options position basics video that (1) starts the position with an options short (2) discusses a stock trade with a position trade setup (3) discusses a stock buy to protect the short options.

Be the first to comment