I was going to discuss these charts in a renko chart recording training video, but the key aspects that I want to discuss are not the trade setups and real time timing, since they were base setups on both the renko chart and the price tick chart.

There will be a lot of discussion about expanding the size of a trade profit past the identified profit target by reading renko brick continuation and mex flow at the time it is hit.

So, what I especially want to focus on in the video are the following: (1) was the renko buy not taken because of a brick that was called resistance (2) where was the buy partial target1 and could it be expanded (3) was there a sell reverse trade setup?

Renko Chart And Tick Chart Buy Setup

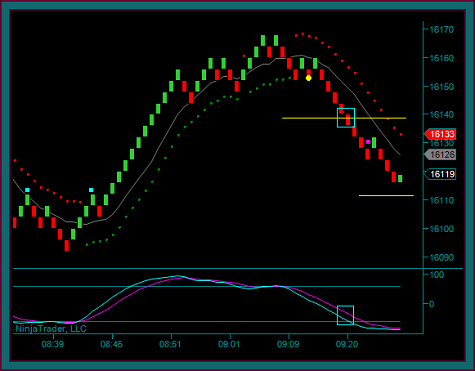

Yellow dot 16111 buy

- Renko base trade setup

- With 2 blue square triple break component

- Partial target1 at the yellow line 16138

But then I wonder if there were people who didn’t take the trade, because they called it a trade into the purple line as resistance.

Except the purple line is an irrelevant price – how do I know this?

180t chart buy setup

- You can see that your trade setup is ‘double base’, meaning that the renko buy synched with a 180 tick buy

- And you can also see the purple line on a price chart – there is no reason to call that resistance

- But even if it was it wouldn’t matter – because the failure of that price would have been setup by the hit at the purple square, preceding the buy entry

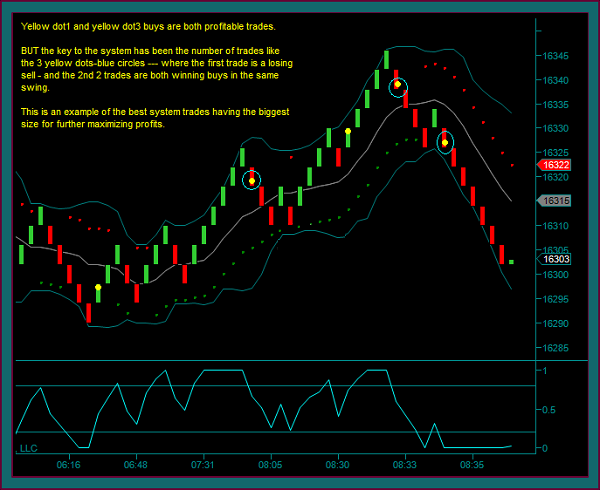

Expanded renko chart trade buy partial setup

What made this trade setup so good was that it started with an expanded partial – 16111 to 16138 = 27 points, which is more than the average partial target.

What made the actual trade so good was that the partial was expanded even further

- You can see the blue boxes at the time the target was hit

- Break with continued green renko bricks and still with mex flow

- 2 partials were taken at the purple squares 16150 – expanded by another 12 points

180t chart and double partial

- Here is another look at the partial timing on the 180 tick

- With the momentum extreme and mex cross – the decision was made to take the 2 partials

Renko Chart And Tick Chart Sell Setup

Yellow dot 16154 sell reverse

- Buy held on the price envelope reverse, with the bricks inside the envelope and confirmation from the 180t dc dots

- The yellow line is the overnight high that has broken and shifted to resistance

- Sell the price and midline reject with mex flow

- If there is any issue it’s 16138 now as a target – 16 points is a little smaller than I would like for partial1

- But it is acceptable and if 16138 could break similarly to the buy, there is very good additional left side diagonal breakout potential

- NOTE: Just because 16138 was ignored on the buy swing, doesn’t mean it shouldn’t still be watched – especially now that it will be a resistance to support shift line

Expanded renko chart sell trade partial setup

- Again we did get the opportunity to expand the partial

- 16130 partial1 at the purple square = 8 points expanded partial

- Unlike the buy, only 1 partial was taken – Why?

180t chart and partial

- The primary reason for the double partial was a combination of how big the partial had become, along with the mex cross

- The sell partial, which syncs with the yellow square isn’t as big and mex was extreme, but hadn’t crossed yet

- So the decision to take 1 and try to get a bigger partial 2 was made

- The renko chart got another green brick but no mex cross on that chart yet

- And mex on the 180 tick chart is opening again – so I still haven’t taken partial2

- Partial2 was done at 16113, which was a pmd low test of the area of the buy breakout – the swing low was 16110

There were a number of renko trading strategies discussed in the video, but they all were really related to price and momentum: (1) identifying real price points for determining whether a trade setup has room to a profit target (2) reading momentum at the time a profit target is hit, and give it the chance to break if momentum is still building at the time.

Be the first to comment